(HedgeCo.Net) Anthony Scaramucci—best known as the founder of SkyBridge Capital, former White House Communications Director, and creator of the influential SALT Conference—continues to shape conversations at the intersection of finance, politics, and technology in early 2026. After decades balancing hedge fund leadership, media presence, and bite-sized political commentary, Scaramucci is once again capturing headlines for his evolving views on macro markets, cryptocurrencies, U.S. policy, and institutional investing. What follows is a comprehensive look at what’s new and trending today with one of Wall Street’s most outspoken and multifaceted figures.

I. SkyBridge’s Strategic Pivot in a Choppy Market

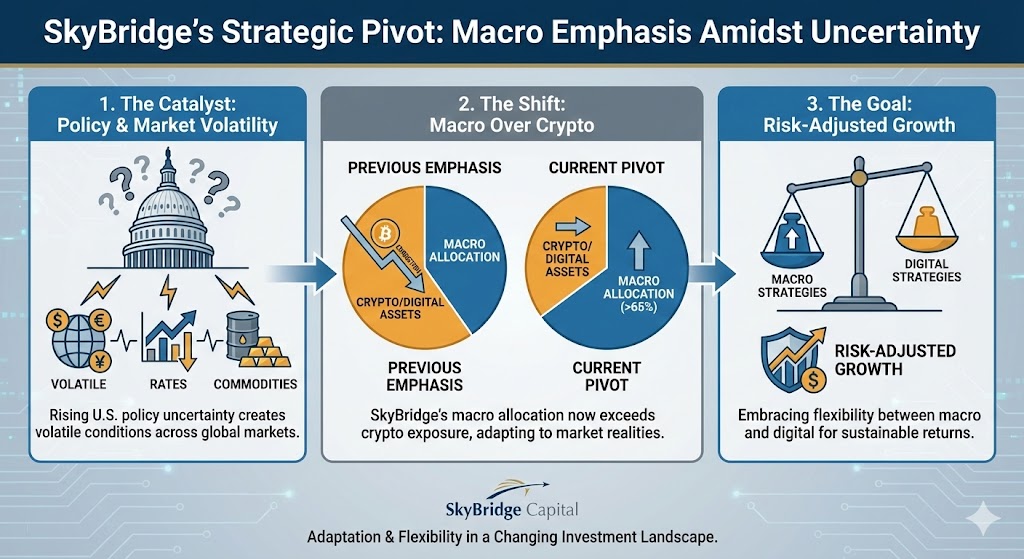

One of the most significant developments linked to Scaramucci this week comes from his flagship firm, SkyBridge Capital. At the 2026 World Economic Forum in Davos, Scaramucci provided forward-looking commentary on how the firm is navigating heightened market volatility amid U.S. policy uncertainty. According to reporting, SkyBridge has shifted its investment mix, allocating a larger portion of capital to macro trading strategies relative to digital assets.

This strategic pivot reflects several broader trends:

- Rising policy uncertainty under the current U.S. administration has created volatile conditions across currencies, rates, and commodity markets—environments where disciplined macro approaches historically thrive.

- SkyBridge’s macro allocation reportedly climbed above 65%, exceeding its exposure to cryptocurrencies as the digital-asset bull run cooled and Bitcoin corrected sharply from last year’s highs.

- Scaramucci acknowledges that while crypto remains part of SkyBridge’s worldview, the firm is adapting to market realities and embracing flexibility between macro and digital strategies.

This trend toward macro emphasis highlights how one of the most crypto-friendly hedge fund founders of the last decade is positioning his business for risk-adjusted growth in uncertain conditions—a telling signal for allocators watching how alternative asset managers reweight portfolios across market cycles.

II. The Bitcoin Narrative: Long-Term Optimism, Short-Term Realism

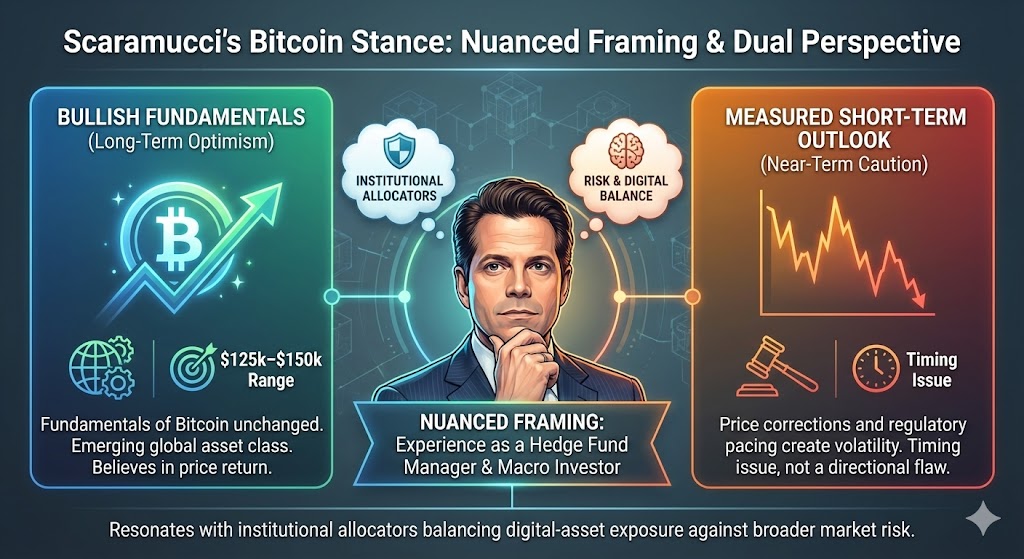

Cryptocurrencies remain a frequent topic of commentary for Scaramucci, but his tone has evolved with market dynamics. Despite a recent downturn in Bitcoin prices from their October 2025 peak, Scaramucci stressed at the Davos forum that the fundamental story of Bitcoin has not changed. He reiterated his belief that price action is more a timing issue than a directional flaw and expressed hope that Bitcoin could return to the $125,000–$150,000 range this year.

This stance aligns with a recurring theme in Scaramucci’s public remarks over the past year:

- He has previously articulated aggressive long-run targets for Bitcoin, citing it as an emerging global asset class.

- At the same time, he has acknowledged that price corrections and regulatory pacing create near-term volatility, making a cautious tone necessary.

His increasingly nuanced framing—bullish fundamentals, measured short-term outlook—reflects both his experience as a hedge fund manager and his evolution from a pure crypto enthusiast to a seasoned macro investor. This dual perspective resonates with institutional allocators grappling with how to balance digital-asset exposure against broader market risk.

III. U.S. Policy Commentary: Stablecoins, Dollar Strength, and Checks & Balances

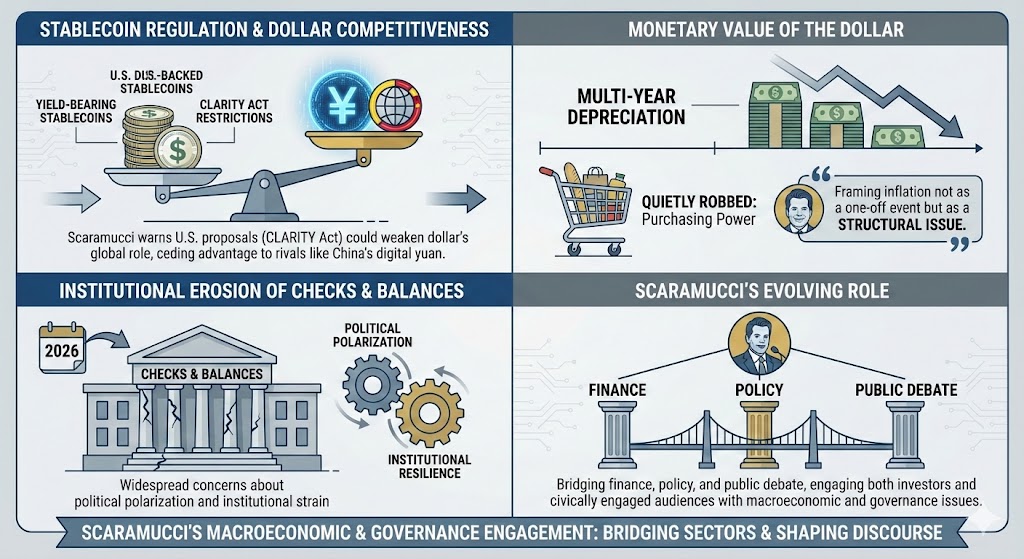

Scaramucci’s influence extends well beyond financial markets into political and economic discourse. In the past few weeks alone, he has weighed in on several trending policy debates:

- Stablecoin Regulation & Dollar Competitiveness: Scaramucci publicly warned that U.S. regulatory proposals—specifically restrictions on yield-bearing stablecoins under the CLARITY Act—could unintentionally weaken the dollar’s global role by ceding advantage to international competitors like China’s digital yuan.

- Monetary Value of the Dollar: On social media, Scaramucci argued that the U.S. dollar has “quietly robbed”Americans of purchasing power through multi-year depreciation, framing inflation not as a one-off event but as a structural issue.

- Institutional Erosion of Checks & Balances: In a recent post on X, he asserted that checks and balances in the U.S. government are under strain, a point that reflects widespread concerns about political polarization and institutional resilience going into 2026.

These comments reveal Scaramucci’s increasing engagement with macroeconomic and governance issues, not merely market predictions. His voice continues to bridge finance, policy, and public debate—an evolving role that keeps him squarely in the conversation for both investors and civically engaged audiences.

IV. Crypto Advocacy Beyond Price: Industry Infrastructure and Regulation

Even as Scaramucci tempers near-term enthusiasm, he continues to champion broader digital-asset adoption—particularly where institutional clarity exists or emerges. This includes commentary from industry forums where he emphasized institutional investment and regulatory foundations as crucial to a strong 2026 for the crypto sector.

Additionally, Scaramucci has publicly recognized industry peers who are shaping the space. For instance, he took to X to praise Michael Saylor as one of the “smartest people in crypto” after engaging with him at a major crypto event—highlighting how thought leadership and network influence remain central to Scaramucci’s strategy.

These interactions serve two purposes:

- Affirm broader institutional legitimacy for blockchain and Bitcoin, especially at a time when regulatory regimes are still crystallizing.

- Signal alignment with key voices in digital finance, helping SkyBridge and Scaramucci maintain relevance and credibility among sophisticated allocators and technologists.

V. Media & Public Platforms: From Podcasting to Global Forums

While finance and policy commentary are central to his current profile, Scaramucci also remains active across media channels. Notably, he co-hosts The Rest Is Politics US, a podcast that blends analysis of political dynamics with broader socio-economic context. According to his public profile, the show has continued beyond the 2024 election cycle due to strong reception.

Simultaneously, Scaramucci’s presence at major global forums such as Davos underscores how he has transitioned from hedge fund CEO to global thought leader on markets, policy, and technology. These platforms amplify his views well beyond SkyBridge clients and into conversations with policymakers, investors, and corporate executives.

VI. The SALT Legacy & the Next Chapter

Underlying much of Scaramucci’s contemporary impact is the SALT Conference, the hedge-fund-centered thought leadership forum he founded in 2009. Known as one of the most prominent meetings of Wall Street and global finance leaders, SALT has historically set agendas on macro trends, alternative investing, and disruptive technologies.

Although SALT’s most flamboyant years are behind it, Scaramucci’s continued leadership in the alternative investment ecosystem—through SkyBridge, media platforms, and public discourse—represents a new chapter: influence that operates through commentary, strategic positioning, and networking as much as through direct asset management. This hybrid role is increasingly common among leaders who seek to shape markets not only with capital but with ideas.

Conclusion: Scaramucci’s 2026 Narrative Arc

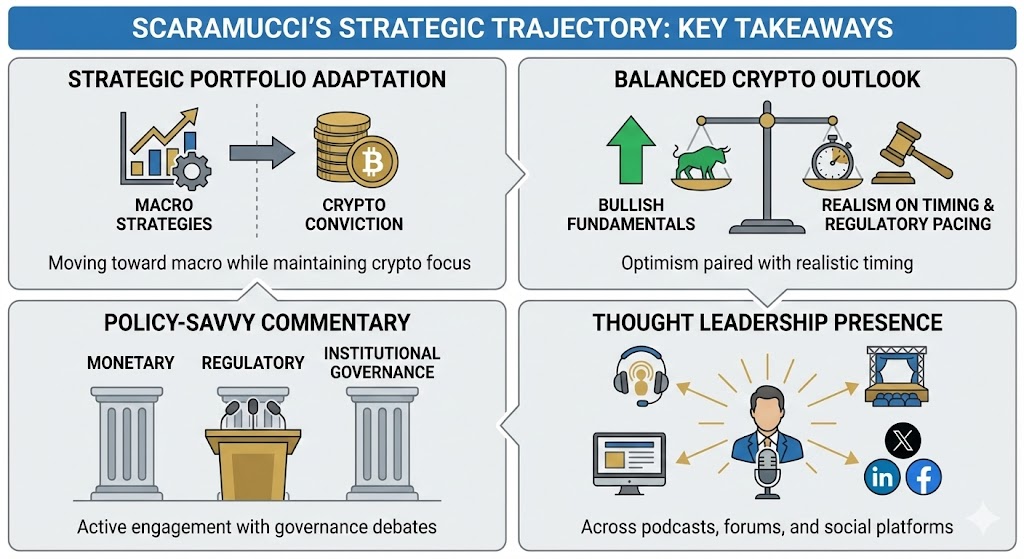

Anthony Scaramucci in 2026 is a different figure than he was in 2017 or even 2024. He remains intensely connected to crypto advocacy but has adopted a more disciplined, macro-aware investment posture in response to market conditions. He is outspoken on U.S. policy debates, particularly where economics intersects with regulatory frameworks. Meanwhile, his media engagements and global forum appearances position him as a bridge between finance, politics, and technology.

- Strategic portfolio adaptation: Moving toward macro strategies while maintaining crypto conviction.

- Balanced crypto outlook: Bullish fundamentals paired with realism on timing and regulatory pacing.

- Policy-savvy commentary: Active engagement with monetary, regulatory, and institutional governance debates.

- Thought leadership presence: Across podcasts, forums, and social platforms.

In a year that promises continued uncertainty across markets and geopolitics, Scaramucci’s voice—whether embraced or contested—will remain one of the most watched by investors, policymakers, and media alike.