(HedgeCo.Net). In 2026, “real assets” isn’t just about owning buildings, roads, and pipelines. It’s about owning the infrastructure that powers a digitizing economy. Brookfield has been explicit: rising electricity demand, AI adoption, and supply-chain reorientation are driving a multi-decade investment cycle—and the firm is tying its strategy to that theme.

Brookfield’s own materials highlight investment ramping to meet global power needs, and its 2026 positioning includes references to raising significant capital for AI infrastructure.

What’s happening

Brookfield is leaning into a 2026 message centered on power scarcity and infrastructure buildout—framing the moment as a defining period for global markets. Whether the investment is in generation, transmission, data center ecosystems, or related real assets, the core bet is that electrification + AI workloads create durable demand for long-life assets.

Why this is trending across the largest alternative firms

Brookfield isn’t alone. The “power trade” is becoming a dominant theme across major alts platforms because it connects multiple investable lanes:

- Infrastructure equity (regulated assets, contracted cash flows)

- Infrastructure credit (asset-backed lending, project finance structures)

- Real estate adjacencies (data centers, logistics, specialized industrial)

- Transition assets (renewables, storage, grid modernization)

In other words: it’s a theme large enough to absorb billions annually—exactly what mega-managers need.

The operational edge becomes the alpha source

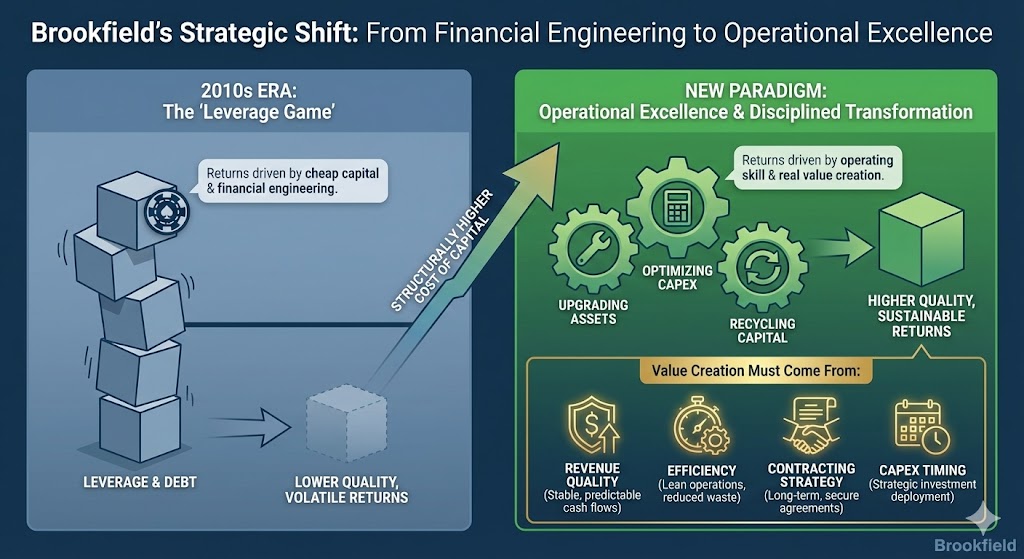

A major Brookfield emphasis is disciplined transformation and operational excellence—suggesting that returns won’t be won by leverage games, but by operating skill: upgrading assets, optimizing capex, and recycling capital.

That’s a notable shift for the industry. If cost of capital is structurally higher than the 2010s, value creation must come from:

- revenue quality,

- efficiency,

- contracting strategy,

- and capex timing.

The allocator takeaway: infrastructure is splitting into “haves” and “have-nots”

As the theme gets crowded, not all capital is equal. The winners will likely be managers who can:

- source proprietary projects,

- navigate permitting and regulation,

- execute buildouts,

- and manage multi-asset portfolios through cycles.

For allocators, the due diligence bar rises:

- How does the manager control downside in construction risk?

- What percentage of cash flow is contracted vs merchant?

- How do they hedge power and commodity exposures?

- What’s the exit plan—hold forever, recycle, or IPO?

What to watch next

- Fundraising direction: follow whether Brookfield and peers raise dedicated AI infrastructure vehicles or embed the theme across flagship funds.

- Deal types: generation vs grid vs data center ecosystems—each carries different risk profiles.

- Regulatory changes: power markets and permitting can reprice investments rapidly.

- Competition: strategics (utilities, hyperscalers) are increasingly bidders too.

Bottom line: Brookfield is betting that “power” becomes the defining real-assets investment theme of the era. In 2026, that bet is no longer contrarian—it’s quickly becoming consensus, and the arms race is about who can execute at scale.