(HedgeCo.Net) The hedge fund industry is entering 2026 with renewed momentum, but few stories loom as large—or carry as many implications for capital markets—as the next chapter unfolding at Pershing Square Capital Management. At the center of the story is its founder and chief investment officer, Bill Ackman, who is moving closer to one of the most consequential strategic decisions of his career: taking Pershing Square public.

After months of market speculation and incremental disclosures, Ackman is actively laying the groundwork for a dual public listing in 2026—one that would combine a public offering of the management company itself with the launch of a new U.S.-listed closed-end investment fund, targeted at raising approximately $5 billion. If executed, the transaction would represent one of the most high-profile hedge fund listings in more than a decade and could reshape how alternative asset managers think about scale, permanence, and access to capital.

This is not merely a corporate finance event. It is a referendum on the hedge fund business model at a moment when institutional allocators are once again warming to active management, and when the boundaries between public and private capital are being redrawn.

A Rare Move in a Historically Private Industry:

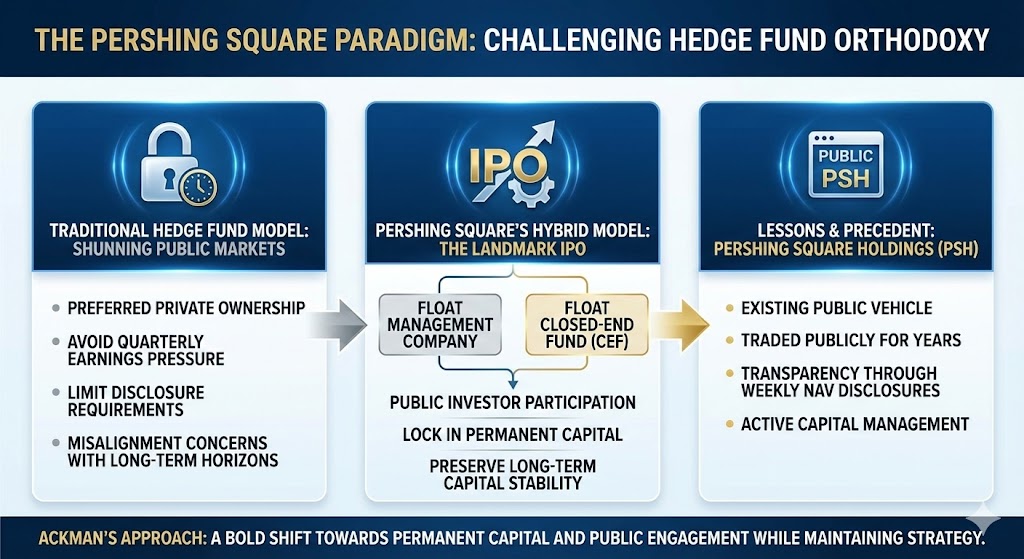

Hedge funds have traditionally shunned public markets. Unlike private equity firms—which have increasingly embraced IPOs to lock in permanent capital—most hedge fund managers have preferred to remain privately held, citing concerns over quarterly earnings pressure, disclosure requirements, and misalignment with long-term investment horizons.

Pershing Square’s contemplated IPO challenges that orthodoxy.

By floating both the management company and a closed-end fund, Ackman is effectively proposing a hybrid model: one that allows public-market investors to participate in Pershing Square’s economics while preserving long-term capital stability for the investment strategy itself.

Industry observers note that this approach draws on lessons from Pershing Square’s existing public vehicle, Pershing Square Holdings, which has traded publicly for years while offering transparency through weekly net asset value (NAV) disclosures and active capital management.

Why Now? Timing the Market—and the Narrative

The timing of Pershing Square’s IPO push is no accident. The hedge fund industry is emerging from a period of skepticism with a renewed performance narrative. In 2025, hedge funds delivered some of their strongest relative results in years, benefiting from dispersion across equity markets, persistent volatility in rates and currencies, and increased opportunities for active risk management.

Against that backdrop, investor sentiment toward hedge funds has shifted. Institutional allocators are consolidating relationships, directing larger allocations to fewer, higher-conviction managers, and showing renewed willingness to pay for differentiated alpha.

For Ackman, the improving macro environment provides a more receptive audience—not only among institutions, but also among public-market investors seeking exposure to alternative strategies without committing to traditional private fund structures.

Inside the Dual-Listing Strategy:

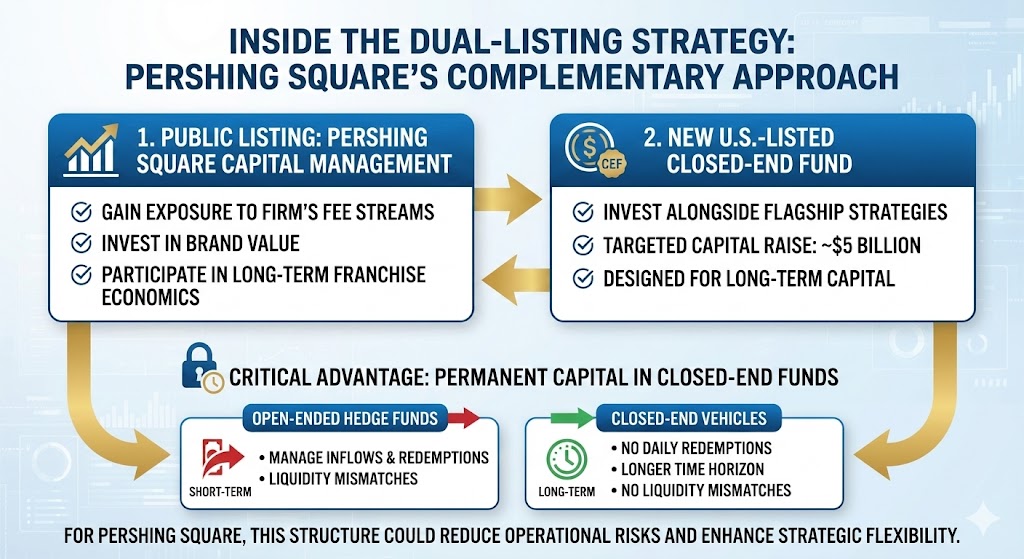

The proposed transaction under discussion involves two complementary components:

- A public listing of Pershing Square Capital Management, allowing investors to gain exposure to the firm’s fee streams, brand value, and long-term franchise economics.

- A new U.S.-listed closed-end fund, designed to invest alongside Pershing Square’s flagship strategies, with a targeted capital raise of approximately $5 billion.

Closed-end funds offer a critical advantage in hedge fund structures: permanent capital. Unlike open-ended hedge funds, which must manage inflows and redemptions, closed-end vehicles allow managers to invest with a longer time horizon and without liquidity mismatches.

For Pershing Square, this structure could reduce operational friction while broadening its investor base well beyond traditional institutional allocators.

Pershing Square Holdings: A Preview of What’s to Come

The clearest window into how Pershing Square might operate as a public entity already exists in the form of Pershing Square Holdings. The publicly traded investment company has become a cornerstone of Ackman’s capital strategy, offering weekly NAV updates, transparent portfolio reporting, and active share repurchase programs.

As of mid-January 2026, Pershing Square Holdings reported a NAV of approximately $87 per share, with modestly positive year-to-date performance and continued buybacks in the open market. The buybacks are widely viewed as a signal of capital discipline and management confidence—traits that public investors will scrutinize closely in any future IPO.

The experience with Pershing Square Holdings also underscores Ackman’s comfort operating under public-market scrutiny, a hurdle that has deterred many hedge fund peers from pursuing similar paths.

Performance Matters—And Pershing Has Momentum

While the IPO narrative dominates headlines, performance remains the ultimate currency in hedge funds. Pershing Square entered 2026 with solid momentum following a constructive end to 2025, as equity markets rewarded active positioning and selective concentration—hallmarks of Ackman’s investing style.

Although returns were not universally spectacular across the industry, consistency and risk-adjusted performance have become increasingly valued by allocators. Pershing Square’s emphasis on concentrated, high-conviction positions stands in contrast to the sprawling multi-strategy platforms that dominate today’s asset-gathering league tables.

In an environment where investors are questioning whether scale dilutes alpha, Pershing Square’s approach offers a differentiated narrative—one that may resonate particularly well with public-market investors seeking clarity and conviction.

Implications for the Hedge Fund Industry

Pershing Square’s IPO ambitions carry implications far beyond a single firm. If successful, the listing could become a proof of concept for hedge funds seeking alternative paths to scale and permanence without morphing into sprawling asset-gathering machines.

Several broader themes emerge:

- Permanent Capital as a Strategic Advantage: Closed-end funds and public vehicles reduce liquidity risk and enable longer-term investing.

- Brand as an Asset: In a crowded hedge fund universe, recognizable brands may hold increasing value in public markets.

- Retail Access to Alternatives: Public listings could further blur the line between institutional and retail participation in hedge fund strategies.

- Fee Transparency Pressure: Public ownership may accelerate scrutiny of hedge fund economics, margins, and governance.

Industry executives are watching closely. While few hedge fund managers are likely to rush toward IPOs, Pershing Square’s experience could influence how the next generation of firms structures itself.

Risks and Open Questions

Despite the optimism, significant risks remain. Public markets can be unforgiving, particularly when investment performance diverges from expectations. Quarterly earnings volatility, fee compression concerns, and regulatory scrutiny all loom larger for publicly listed asset managers.

There is also the question of valuation. Unlike private equity firms with long-duration fee streams, hedge fund revenues can be more cyclical, tied closely to performance and assets under management. Convincing public investors to assign premium multiples to those earnings may prove challenging.

Finally, market timing remains critical. Equity markets in early 2026 are constructive but not without volatility. A sharp risk-off episode could delay or derail IPO plans, regardless of strategic merit.

What to Watch in 2026

As Pershing Square moves closer to execution, several milestones will be closely watched by investors and industry insiders alike:

- Formal IPO filings or regulatory disclosures

- Clarification on listing venue and structure

- Marketing strategy for the closed-end fund

- Ongoing performance and NAV trends at Pershing Square Holdings

- Signals from institutional allocators regarding participation

Each step will offer insight into whether Pershing Square’s ambitious plan can bridge the worlds of hedge funds and public capital markets.

Conclusion: A Defining Moment for Pershing—and Possibly the Industry

Pershing Square’s IPO initiative is more than a corporate transaction; it is a strategic statement about the future of hedge funds in an evolving investment landscape. By embracing public markets, Bill Ackman is testing whether transparency, permanence, and brand can coexist with the flexibility and performance orientation that define hedge fund investing.

If successful, the move could mark a turning point—not just for Pershing Square, but for an industry long defined by its privacy. As 2026 unfolds, few stories will be watched more closely across Wall Street than this one.