(HedgeCo.Net) The alternative investment industry is often framed as a collection of distinct strategies: private equity, hedge funds, private credit, real assets. In 2026, that framework is rapidly losing relevance.

What is emerging instead is a converged capital ecosystem, shaped by three powerful forces: regulation, infrastructure demand, and financial innovation. Together, they are redefining how alternatives operate—and why they increasingly sit at the center of global capital markets.

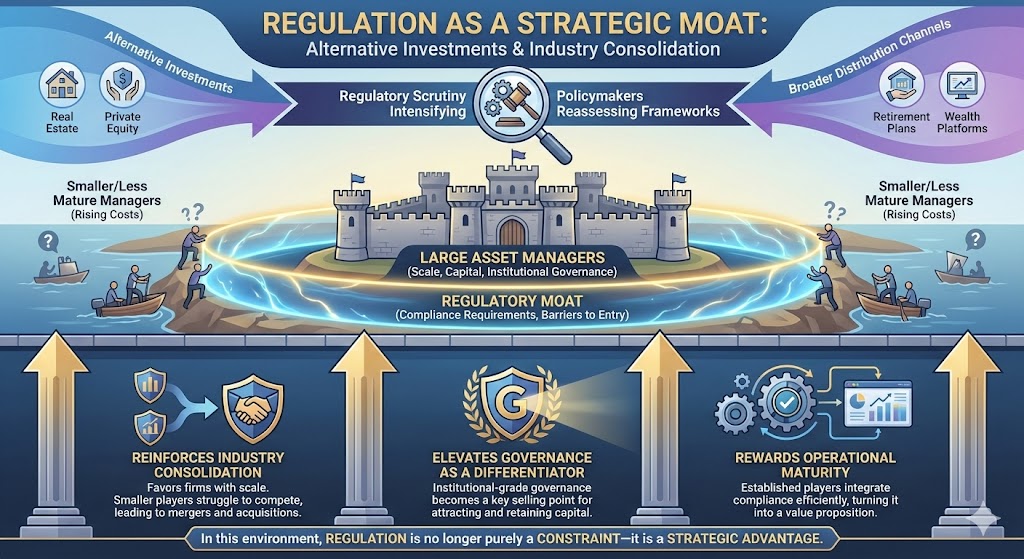

Regulation: From Headwind to Competitive Advantage

As alternative investments move into broader distribution channels, regulatory scrutiny is intensifying. Policymakers are reassessing how private assets fit within retirement plans, wealth platforms, and fiduciary frameworks.

Yet for large asset managers, regulation is no longer purely a constraint—it is a strategic moat.

Compliance requirements raise barriers to entry, favoring firms with scale, capital, and institutional-grade governance. Smaller or less mature managers face rising costs, while established players integrate compliance into their value proposition.

In this environment, regulation:

- Reinforces industry consolidation

- Elevates governance as a differentiator

- Rewards operational maturity

Rather than slowing growth, it is reshaping competition.

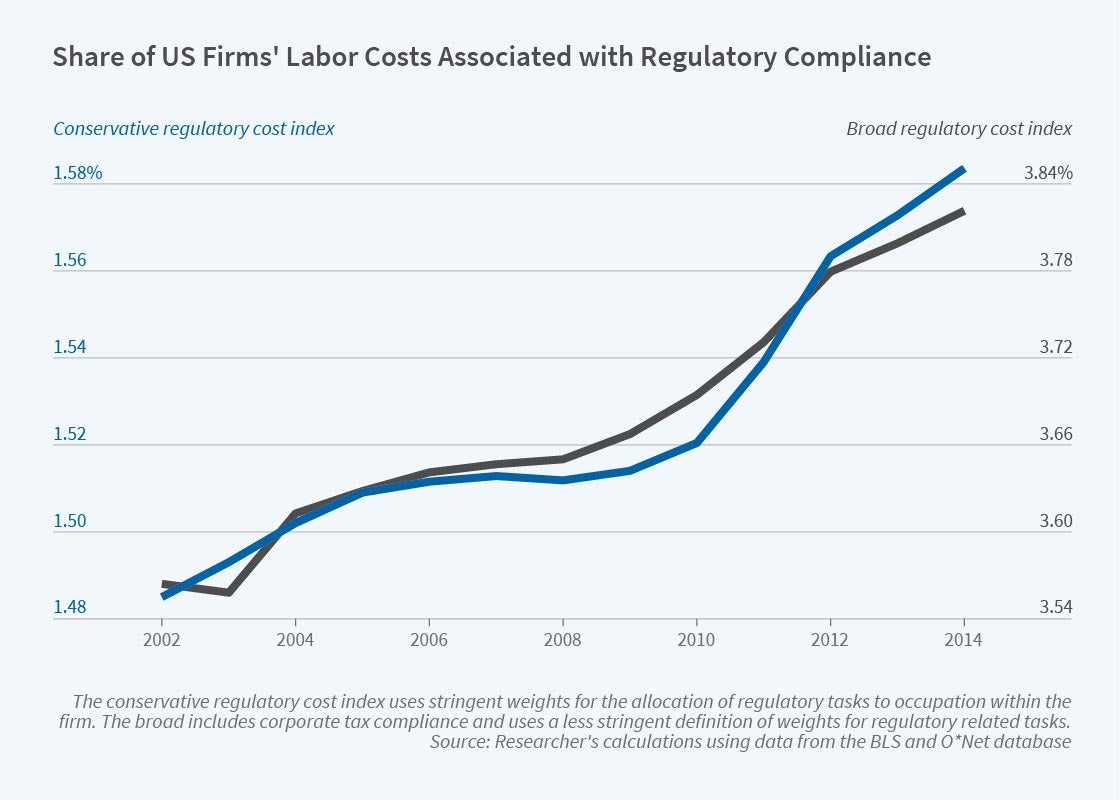

Chart: Regulatory Intensity vs. Manager Scale

Infrastructure: The Spine of the Alternatives Ecosystem

Simultaneously, infrastructure has become the backbone of modern alternative investing.

Data centers, renewable energy, logistics hubs, and digital infrastructure assets are absorbing capital from across the alternatives spectrum. These assets offer long-duration cash flows, inflation linkage, and essential economic utility.

The AI revolution alone is driving explosive demand for compute capacity, power generation, and network connectivity—needs that public markets struggle to finance independently.

Private capital is filling the gap through:

- Hybrid equity-credit structures

- Long-term concession models

- Project finance and structured debt

Infrastructure is no longer a niche—it is the cross-asset meeting point for alternatives.

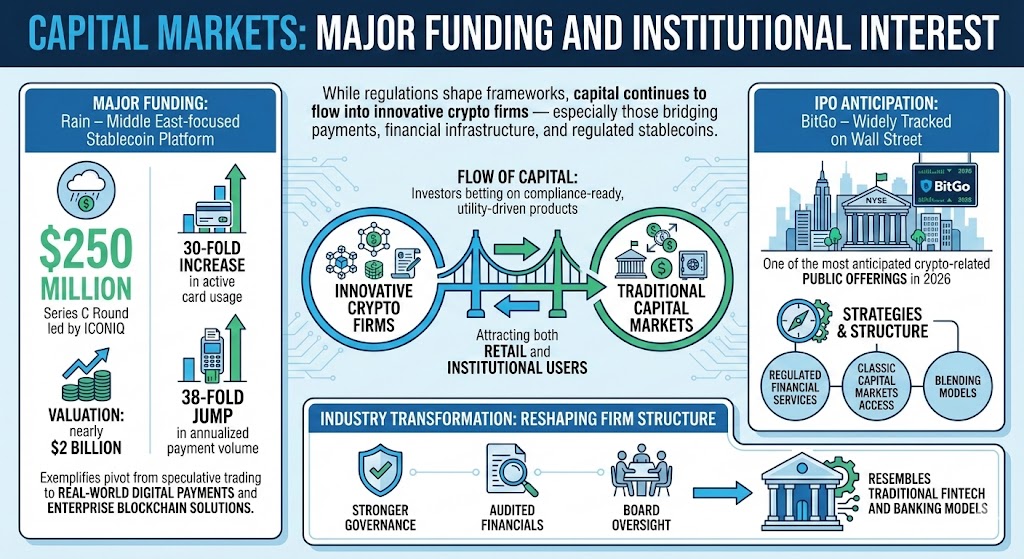

Innovation Expands the Definition of “Alternative”

Financial innovation is further blurring traditional boundaries.

New instruments—ranging from prediction markets to tokenized securities and bespoke risk-transfer solutions—are expanding what qualifies as alternative exposure.

While still emerging, these innovations reflect a broader shift: capital markets are becoming more modular, programmable, and technology-driven.

Large alternative managers are approaching innovation cautiously but deliberately. Pilot programs, strategic partnerships, and controlled experimentation allow firms to maintain stability while positioning for future market structures.

The goal is optionality, not disruption for its own sake.

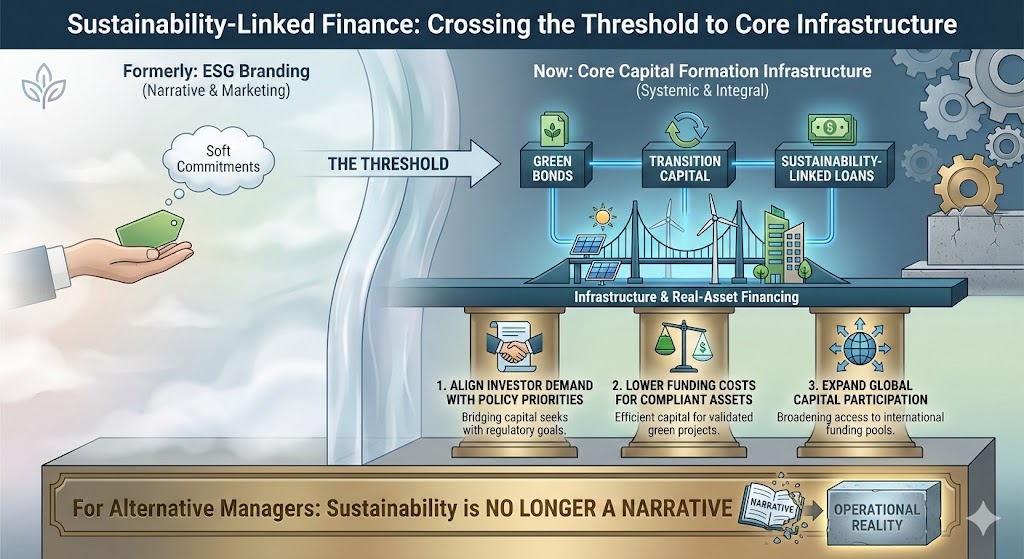

Sustainability Moves from Overlay to Core Strategy

Sustainability-linked finance has also crossed a threshold.

What once existed as ESG branding has evolved into core capital formation infrastructure. Green bonds, transition capital, and sustainability-linked loans are now integral to infrastructure and real-asset financing.

These tools:

- Align investor demand with policy priorities

- Lower funding costs for compliant assets

- Expand global capital participation

For alternative managers, sustainability is no longer a narrative—it is a balance-sheet strategy.

Capital Flows Across Regulation, Infrastructure & Innovation

The New Operating System of Capital

Taken together, regulation, infrastructure demand, and innovation point toward a singular conclusion: alternative investments are becoming the operating system of global capital markets.

They finance what public markets cannot.

They absorb risks banks no longer want.

They adapt faster than traditional structures.

As these forces converge, the distinction between “alternative” and “mainstream” continues to erode.

In 2026, alternatives are no longer operating at the margins of finance. They are increasingly its center of gravity.