(HedgeCo.Net) For most of modern financial history, alternative investments thrived on exclusivity. Access was limited, documentation was complex, and minimum commitments ensured that only institutions and ultra-wealthy investors could participate. In 2026, that model is being dismantled—systematically, strategically, and at unprecedented scale.

The world’s largest asset managers are now locked in what industry insiders increasingly describe as the distribution wars: a high-stakes race to control how private equity, private credit, real assets, and hedge fund strategies reach the next generation of capital.

At the center of this transformation sit firms such as BlackRock, Blackstone, Apollo Global Management, and KKR—organizations that have concluded that future AUM growth will be dictated less by alpha generation alone and more by distribution architecture.

From Institutional Saturation to Distribution Expansion

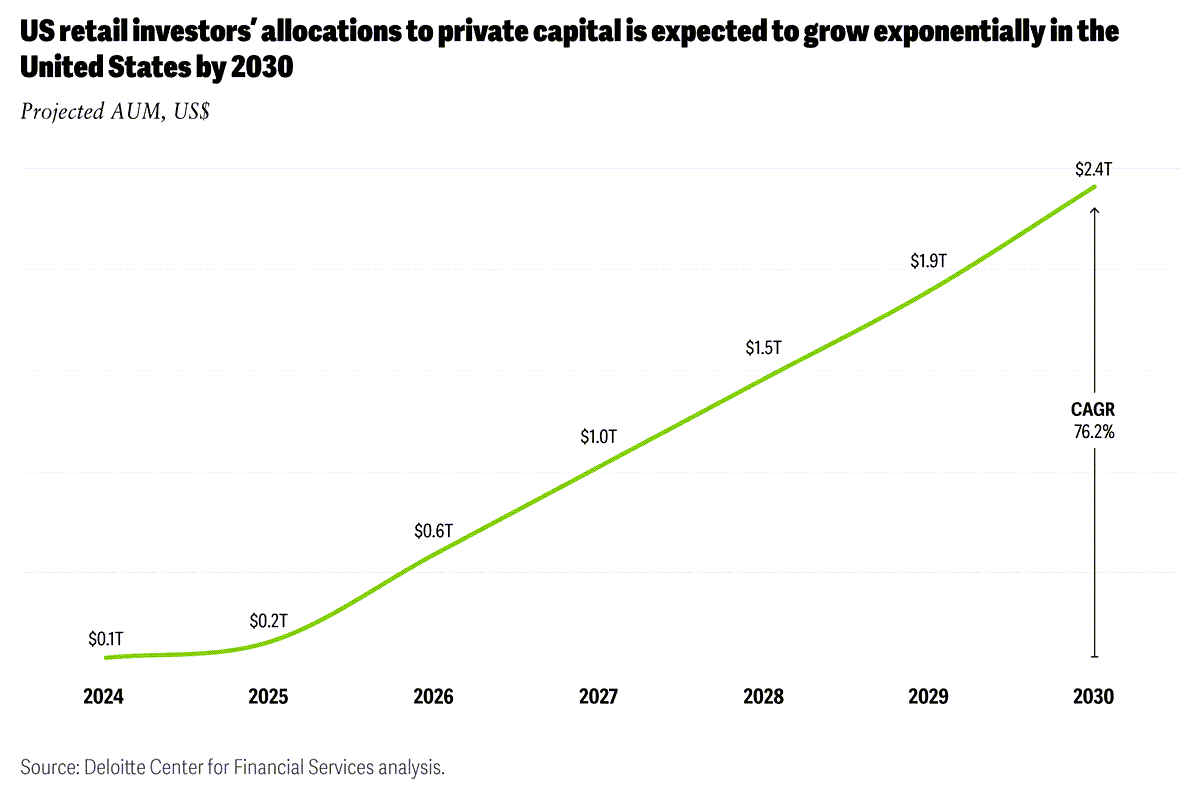

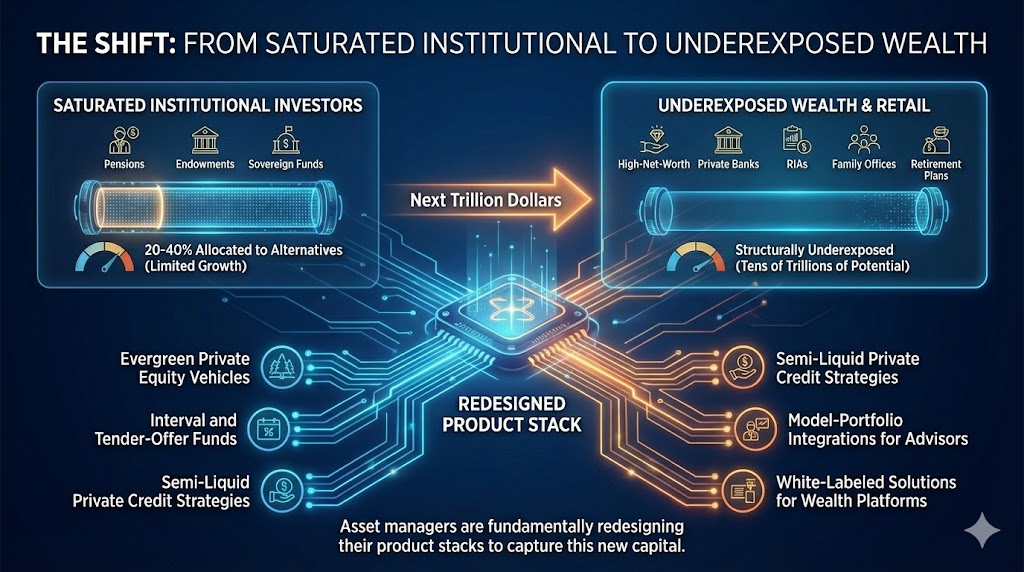

The logic driving this shift is unavoidable. Institutional investors—pensions, endowments, sovereign funds—are largely saturated. Most already allocate 20–40% of portfolios to alternatives, leaving limited room for incremental growth.

The next trillion dollars must come from elsewhere.

That “elsewhere” is found in high-net-worth investors, private banks, RIAs, family offices, and retirement plans, segments that collectively represent tens of trillions of dollars but remain structurally underexposed to private markets.

To capture that capital, asset managers are fundamentally redesigning their product stacks.

Traditional closed-end, drawdown funds are being supplemented—sometimes replaced—by:

- Evergreen private equity vehicles

- Interval and tender-offer funds

- Semi-liquid private credit strategies

- Model-portfolio integrations for advisors

- White-labeled solutions for wealth platforms

These products preserve the economic engine of private markets while aligning with regulatory, liquidity, and operational constraints of broader distribution channels.

Chart: Alternative Assets by Distribution Channel (2020–2026E)

This re-engineering is not cosmetic—it is existential. Firms that fail to modernize distribution risk being outpaced by competitors who embed themselves deeper into advisor workflows and retirement systems.

The Retirement System: The Ultimate Prize

No battleground is more consequential than the U.S. defined-contribution system.

401(k) plans alone represent more than $8 trillion in assets. Even marginal penetration of private markets into this ecosystem could eclipse decades of institutional fundraising.

Large asset managers are now working closely with:

- Recordkeepers

- Plan sponsors

- Consultants

- Regulators

to design vehicles that introduce private-market exposure without violating fiduciary standards or operational constraints.

The argument is compelling: retirement savers are long-duration investors by design. They can tolerate illiquidity and may benefit from the diversification, inflation protection, and income characteristics alternatives provide.

But execution is delicate. Firms must invest heavily in:

- Education and disclosure

- Risk and valuation oversight

- Daily-pricing compatibility

- Governance frameworks

Those that succeed will not merely gather assets—they will become embedded financial infrastructure.

Technology: The Quiet Power Broker

Behind the scenes, technology is accelerating everything.

Digital alternatives platforms, portfolio-construction tools, and compliance automation systems are transforming how advisors interact with private markets. What once required legal teams and manual processes can now be executed through integrated dashboards.

This technological layer is essential. Distribution without education risks misallocation and backlash. Platforms that pair access with analytics, transparency, and portfolio context are shaping sustainable demand.

For asset managers, technology is no longer optional. It is the distribution multiplier that allows global reach without sacrificing control.

Scale, Brand, and Trust

As alternatives move closer to retail-adjacent channels, brand trust becomes paramount.

Investors unfamiliar with private markets gravitate toward names they recognize. This dynamic strongly favors mega-managers with established reputations, institutional track records, and regulatory credibility.

Smaller managers may still outperform—but distribution increasingly rewards those who can combine performance with scale, compliance, and simplicity.

This dynamic is accelerating consolidation across the alternatives ecosystem.

A Structural, Not Cyclical Shift

Critically, this transformation is not driven by short-term market conditions. It is structural.

Public markets are more concentrated. Correlations are higher. Volatility is persistent. Investors are seeking differentiated return sources—and they are willing to trade some liquidity to get them.

The asset managers that dominate the next decade will not simply be the best investors. They will be the best architects of access.

In the distribution wars of alternatives, performance still matters—but control of the pipeline determines victory.