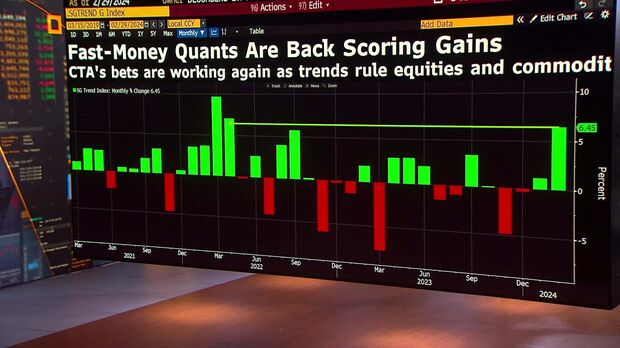

(HedgeCo.Net) A clear performance divide has emerged in 2025 between funds relying on algorithmic trend-following systems and those using discretionary macro and stock-picking strategies. Funds that chase market trends mechanically are under pressure. For example, systematic funds were reported as being down more than 11 % by end-May, versus discretionary-led funds which were up about 7 %. Reuters

Why the split?

- The market regime is changing. Volatility is higher, but market moves are less sustained, more choppy, meaning trend-followers (which rely on momentum) are seeing whipsaws and getting hurt. Goldman Sachs Asset Management

- Discretionary managers are more agile: they adjust asset classes, use fundamental insights, and pivot more quickly. Systematic funds are often slower to adapt, stuck in their code and signals. Reuters

- Some strategies that excelled in the prior low-rate, low-volatility era are less well-suited for the “higher volatility, higher rate” landscape. The more adaptive funds are doing better. Callan+1

What does this mean?

- For investors: If you’re allocating to hedge-funds, strategy matters more than ever. Trend-following alone might struggle in this regime.

- For managers: There’s pressure to reinvent, combine systematic with discretionary, or adopt hybrid models to navigate this environment.

- For the industry: Success will increasingly differentiate between the nimble and the rigid. The winners may be those willing to adapt.

Bottom line:

The dividing line in hedge-fund performance is becoming clearer — trend systems are being tested, while discretionary/macro strategies are gaining favor. Investors should pay attention to the underlying strategy, not just the label.