(HedgeCo.Net) Carlyle’s “new today” story is unusually headline-driven: Reuters reported Carlyle has agreed to buy most of Lukoil’s international assets as sanctions pressure forces the Russian company to retreat from overseas markets—pending approvals and complex regulatory steps. This is the kind of situation where a large U.S. private equity firm can position itself as a “solution buyer” for assets that require expertise, restructuring ability, and political/regulatory navigation.

What’s new today: the Lukoil international assets deal

According to Reuters and the Financial Times, the potential transaction involves Lukoil’s overseas holdings across multiple regions, and is subject to U.S. Treasury/OFAC-related constraints and approvals. Both outlets emphasized the sanctions context and the complexity of executing a deal where proceeds may be constrained or frozen under sanctions regimes.

This is not “typical private equity.” It is geopolitical, regulatory, and operational—exactly the type of complexity premium Carlyle is built to pursue.

Why this deal is strategically significant for Carlyle:

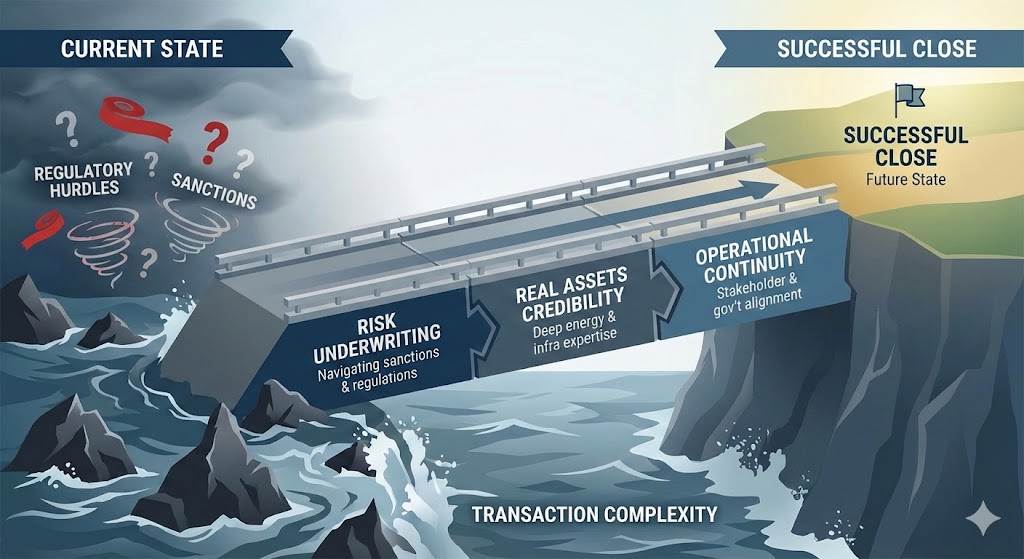

If the transaction progresses, it would underscore several Carlyle strengths:

- Ability to underwrite complex risk. Many buyers cannot—or will not—touch assets tangled in sanctions and regulatory approvals.

- Operational continuity and stakeholder management. These assets may require careful transition planning with governments, employees, and counterparties.

- Real assets credibility. Energy and infrastructure require domain expertise and risk management beyond pure financial engineering.

It also signals a broader point: as geopolitics reshapes supply chains and ownership structures, there can be forced sellers and non-consensus opportunities—moments where private capital’s flexibility is most valuable.

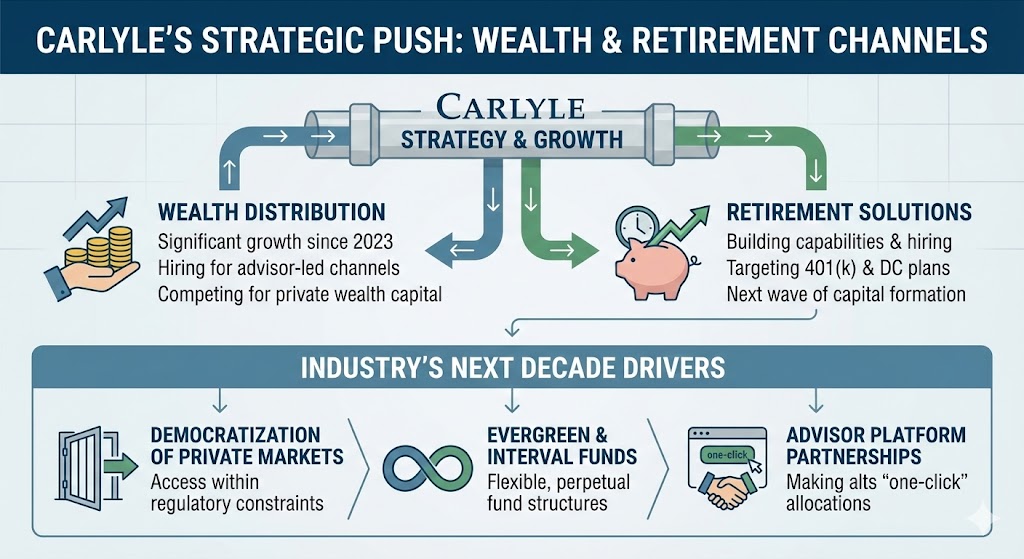

The other Carlyle trend: wealth and retirement channels

Beyond the headline, Carlyle has also been pushing hard into wealth distribution and retirement solutions. Recent reporting notes Carlyle’s wealth business growth since 2023 and hiring aimed at building retirement solutions capabilities, reflecting how mega-managers are competing for the next wave of capital formation in 401(k) and advisor-led channels.

This is critical because the industry’s next decade is likely defined by:

- Democratization of private markets (within regulatory and product constraints)

- Evergreen fund structures and interval funds

- Advisor platform partnerships that make alts “one-click” allocations

2026 outlook: what Carlyle needs to prove

Carlyle’s opportunity set is large, but so is competitive pressure. In 2026, investors will likely grade Carlyle on:

- Execution on complexity deals (like the Lukoil situation) without headline risk turning into value destruction.

- Growth in fee-related earnings driven by stable, scalable products (wealth/retirement).

- Realizations and distribution cadence—the key to unlocking new LP commitments.

What to watch next

For the Lukoil transaction specifically, the market will watch:

- Whether the deal receives required approvals and how conditions affect economics

- How asset carve-outs and exclusions (e.g., regional assets) shape the final package

- The timeline and operational transition plan—especially across multiple jurisdictions