(HedgeCo.Net) Millennium Management’s latest move—creating a dedicated credit trading unit carved out from its fixed-income business—underscores one of the most important shifts in U.S. hedge funds right now: credit is no longer just a sleeve; it’s becoming a strategic vertical with its own capital, leadership, and growth mandate. Bloomberg reported the new unit will be led by Dan Friedman, reporting to co-CIO Justin Gmelich. Hedgeweek also notes the move as part of Millennium’s broader push beyond traditional liquid markets.

This isn’t merely org-chart news. It’s a sign that in 2026, mega multi-strats are trying to capture the full spectrum of credit opportunity—public and private—while tightening specialization inside the platform.

1) Why separate “credit trading” now?

- refinancing risk is real,

- dispersion across issuers is widening,

- capital structure matters again, and

- liquidity conditions can change quickly.

In this world, credit is fertile ground for hedge funds—if the platform is built to handle it. Credit trading across rates, spreads, structured products, and relative value is operationally demanding. It requires specialized risk, financing, and analytics. Creating a dedicated unit signals Millennium wants:

- clearer accountability for credit P&L and risk,

- more specialized hiring and team structure, and

- an internal brand that can compete for talent with other credit powerhouses.

2) The strategic bridge: from liquid credit to private credit economics

The most important meta-trend isn’t just “credit trading.” It’s the convergence of:

- liquid credit trading (hedge-fund style) and

- private credit / structured credit (private-markets style)

Even if Millennium’s unit is framed as a trading business, the industry trajectory is pulling the largest hedge funds toward credit products that look and feel closer to private markets: longer-duration fee streams, scalable AUM, and stickier client relationships.

This convergence is happening because clients are asking for:

- yield (and yield stability),

- diversification away from equities, and

- strategies that can monetize dislocations in refinancing cycles.

Reuters’ Breakingviews has argued that private credit’s evolution will increasingly make it resemble “plain old credit,” reinforcing the idea that boundaries between public and private credit ecosystems are blurring. The hedge-fund implication: firms that can operate across the boundary—trading liquidity when it exists, structuring and holding when it doesn’t—have a strategic edge.

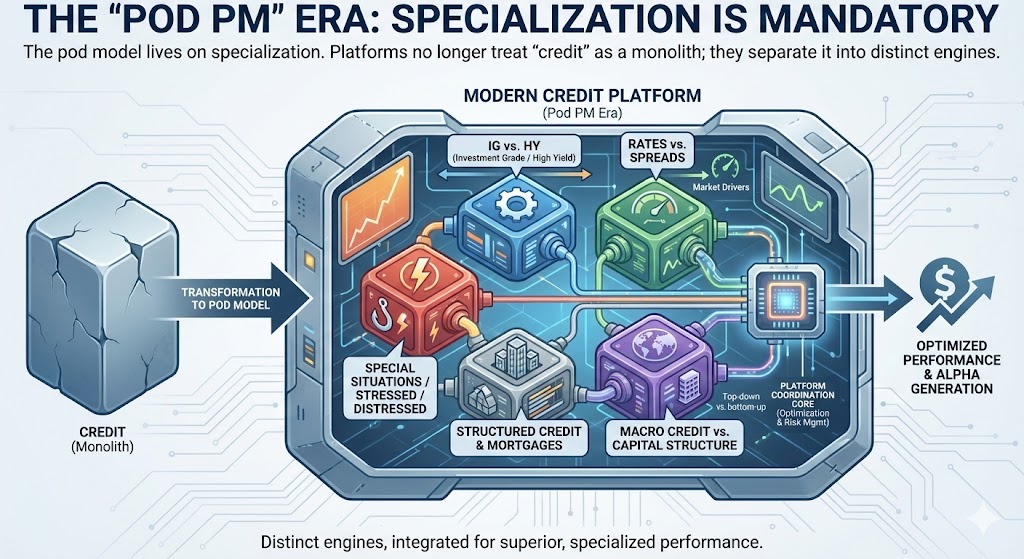

- IG vs. HY,

- rates vs. spreads,

- macro credit vs. capital structure,

- structured credit and mortgages,

- special situations / stressed / distressed

A dedicated credit trading unit is, therefore, a governance tool: it helps Millennium allocate risk more precisely, evaluate performance more cleanly, and recruit PMs with sharper mandates.

4) What allocators will care about

For institutional investors, credit expansion at a mega-fund raises a handful of due-diligence questions:

- Correlation control: does more credit mean more “left-tail” exposure in downturns?

- Liquidity profile: how much of the book relies on financing or thinner markets?

- Risk governance: are scenarios, stress tests, and concentration limits evolving with the product?

- Talent churn: does the unit stabilize leadership and reduce key-person risk?

If Millennium can demonstrate that its platform reduces the classic credit blow-up pathways—crowding, liquidity gaps, financing squeezes—this is exactly the kind of build that attracts incremental allocator dollars.

5) What’s next to watch

- Hiring signals: new PMs and team builds will show what sub-strategies Millennium is prioritizing

- Productization: whether credit becomes a more explicit client-facing “pillar” inside the platform

- Cross-platform integration: tighter links between credit, macro, and equities for capital-structure trades

Bottom line: Millennium’s credit unit is a direct response to 2026’s opportunity set: higher dispersion, more refinancing stress, and investor demand for scalable yield strategies. It’s also a reminder that the biggest hedge funds increasingly behave like diversified financial institutions—building business lines, not just books.