(HedgeCo.Net) The private investment ecosystem is undergoing a fundamental reordering — and private wealth is now at the center of it. What was once a market dominated by pensions, endowments, and sovereign wealth funds is increasingly being powered by high-net-worth individuals, family offices, and the upper mass-affluent segment. In 2026, private investment vehicles designed for individuals represent the fastest-growing segment of a roughly $240 billion private-market access industry, fundamentally altering how capital is raised, deployed, and managed.

This shift is not merely about distribution. It is changing portfolio construction, liquidity design, manager behavior, and even how risk propagates through the alternative investment ecosystem. As private wealth capital scales, the private markets are becoming broader, deeper — and more complex.

From Institutional Monopoly to Shared Capital Engine

For decades, private markets were structurally closed to individuals. High minimums, decade-long lockups, capital call mechanics, and opaque reporting effectively limited participation to large institutions and ultra-wealthy families with dedicated investment staff.

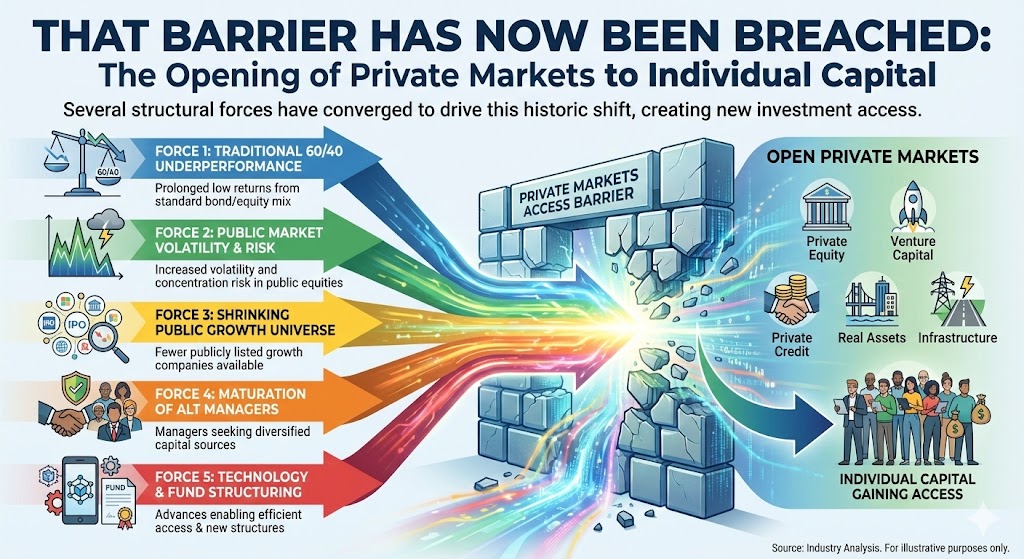

Several structural forces have converged to drive the opening of private markets to individual capital:

- The prolonged underperformance of traditional 60/40 portfolios

- Increased volatility and concentration risk in public equity markets

- The shrinking universe of publicly listed growth companies

- The maturation of alternative asset managers seeking diversified capital sources

- Advances in technology and fund structuring

As a result, private wealth is no longer a marginal participant. It is becoming a core capital provider across private equity, private credit, real assets, secondaries, and select hedge fund strategies.

Why Private Wealth Capital Is Accelerating

The surge of individual capital into private markets is not accidental. It reflects a rational response to structural changes in global investing.

1. Public Markets No Longer Capture the Full Growth Cycle

Companies are staying private longer. Venture-backed firms often delay IPOs for a decade or more, meaning much of their value creation occurs outside public markets. For investors confined to listed equities, this represents a growing opportunity cost.

Private market access allows wealth investors to participate earlier in company lifecycles, infrastructure buildouts, and asset development phases traditionally reserved for institutions.

2. Income Demand in a Volatile Rate Environment

Private credit, infrastructure debt, and asset-backed strategies offer floating-rate or contractual income streams that appeal to investors seeking yield without full equity risk.

In a higher-for-longer rate environment, these strategies have become particularly attractive to wealth investors navigating inflation uncertainty and bond market volatility.

3. Portfolio Diversification Beyond Correlated Assets

Public equities and bonds have shown increasing correlation during periods of stress. Private investments — while not immune to economic cycles — offer differentiated return drivers, valuation smoothing, and alternative cash-flow profiles.

For private wealth portfolios, this diversification appeal has become central to allocation decisions.

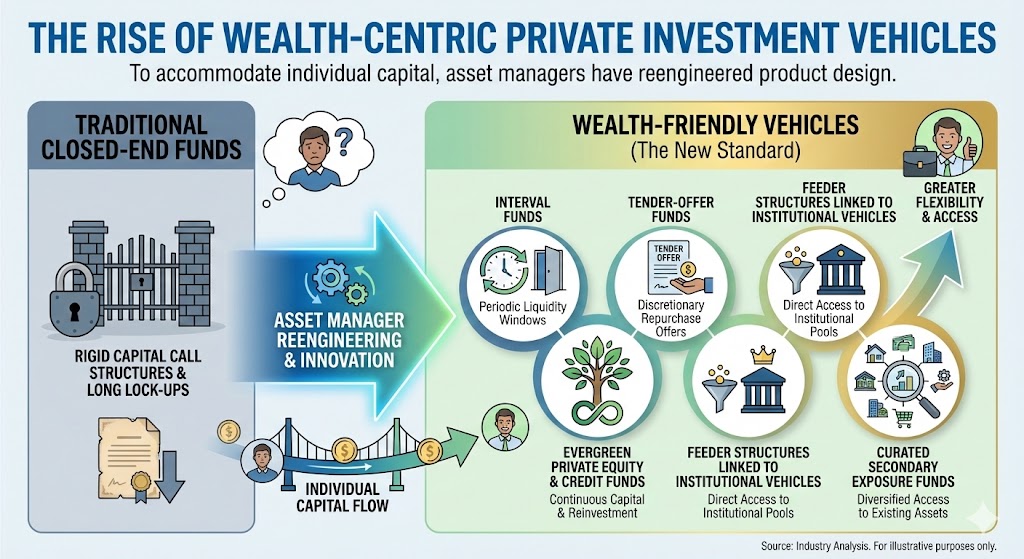

To accommodate individual capital, asset managers have reengineered product design.

Traditional closed-end funds with rigid capital call structures are being supplemented — and in some cases replaced — by wealth-friendly vehicles, including:

- Interval funds

- Tender-offer funds

- Evergreen private equity and credit funds

- Feeder structures linked to institutional vehicles

- Curated secondary exposure funds

These vehicles prioritize accessibility, simplified onboarding, and periodic liquidity — often at the expense of some return optimization. For many investors, that tradeoff is acceptable.

The result is a parallel private market infrastructure built specifically for wealth channels.

Secondaries Become the Gateway Strategy

Among all private market segments, secondaries have emerged as the most natural entry point for individual capital.

Secondary strategies offer:

- Shorter duration

- Earlier cash flows

- Reduced blind-pool risk

- Improved visibility into underlying assets

For wealth investors wary of long lockups and capital calls, secondaries provide a compelling compromise between access and liquidity discipline.

As a result, secondary-focused vehicles designed for individuals are absorbing a disproportionate share of new inflows, reshaping pricing dynamics and deal competition.

Family Offices as the Bridge Between Worlds

Family offices occupy a unique position in this transformation. They operate with institutional sophistication but private capital flexibility, allowing them to act as both allocators and co-investors.

In 2026, family offices are:

- Directly backing private credit originators

- Participating in GP-led secondary transactions

- Building bespoke co-investment portfolios

- Partnering with asset managers on new vehicles

Their influence extends beyond capital. Family offices are increasingly shaping governance expectations, fee structures, and reporting standards — especially in mid-sized private funds.

Liquidity Expectations: The Defining Constraint

As private wealth enters private markets at scale, liquidity tension has become the central structural challenge.

Individual investors are accustomed to:

- Daily pricing

- Regular income

- Redemption flexibility

Private assets, by contrast, are inherently illiquid and episodic in cash flow. Reconciling these realities requires careful engineering.

Industry responses include:

- Quarterly or semiannual liquidity windows

- Redemption caps and gates

- Blended portfolios combining liquid and illiquid assets

- Explicit education around exit pacing

Despite these safeguards, liquidity mismatches remain a systemic risk — particularly during market stress. The lessons from recent redemption pressure in certain private credit vehicles have reinforced the need for discipline over growth.

How Manager Behavior Is Changing

The influx of private wealth capital is reshaping how alternative asset managers operate.

Key changes include:

1. Product Design Overhaul

Managers are increasingly designing strategies from inception with wealth capital in mind, rather than retrofitting institutional funds.

2. Distribution Becomes Strategic

Dedicated private wealth distribution teams now rival institutional fundraising groups in size and importance.

3. Reporting and Transparency Improve

Wealth investors demand clearer reporting, simplified performance metrics, and more frequent communication — pushing managers toward higher transparency standards.

4. Fee Sensitivity Increases

While alternatives remain premium products, fee structures are under greater scrutiny as wealth investors compare options across asset classes.

Systemic Implications for Private Markets

The growing role of private wealth capital has implications beyond individual portfolios.

Market Depth and Stability

Broader participation increases capital availability and market depth — but can also introduce pro-cyclical behavior if liquidity expectations are mismanaged.

Pricing Dynamics

Increased competition for assets, particularly in secondaries and private credit, is compressing spreads and forcing managers to differentiate through structuring and specialization.

Regulatory Attention

As private markets intersect more directly with household wealth and retirement savings, regulatory scrutiny is likely to intensify — particularly around disclosures, suitability, and liquidity management.

What Comes Next

Private wealth’s role in private markets is still evolving.

Looking ahead, several trends are likely to define the next phase:

- Greater segmentation between institutional-grade and wealth-grade strategies

- Continued innovation in semi-liquid structures

- Expanded use of technology to manage subscriptions, reporting, and risk

- Increased emphasis on education and advisor engagement

- More explicit regulatory frameworks governing access and disclosures

Importantly, private wealth is not replacing institutional capital — it is augmenting and reshaping it.

Key Takeaways for Investors and Managers

- Private wealth is now a structural force in private markets.

Its influence will continue to grow. - Secondaries and private credit are the primary entry points.

Duration and liquidity matter more than ever. - Liquidity discipline is non-negotiable.

Growth without alignment risks long-term damage. - Manager selection and structure matter more than branding.

Not all access is created equal.