(HedgeCo.Net) For more than a decade, private credit has been one of the fastest-growing segments of the alternative investment universe. Fueled by bank retrenchment, post-crisis regulation, and an extended era of low interest rates, private lenders stepped into the void—providing flexible capital to middle-market companies and delivering attractive yield to institutional investors.

In 2026, that long-running expansion is showing its first meaningful cracks.

Across business development companies (BDCs), interval funds, and certain semi-liquid credit vehicles, billions of dollars in investor withdrawals have emerged, forcing the private credit industry into a moment of recalibration. While the asset class is far from crisis, the withdrawals mark a critical inflection point—testing liquidity assumptions, portfolio construction, and investor expectations in ways the sector has rarely experienced at scale.

A decade of uninterrupted growth meets changing conditions

Private credit’s rise was built on powerful structural tailwinds. As traditional banks pulled back from leveraged lending following the Global Financial Crisis, alternative asset managers stepped in. Firms such as Apollo Global Management, Blackstone, Ares Management, and KKR scaled direct lending platforms that promised floating-rate exposure, downside protection, and steady income.

Assets poured in. By the mid-2020s, private credit had grown into a market exceeding $1.7 trillion globally, becoming a cornerstone allocation for pensions, insurance companies, and wealth platforms alike.

But the macro environment that fueled that growth has shifted.

Higher interest rates, tighter financial conditions, slowing corporate earnings, and rising refinancing risk have altered the risk-reward profile of private credit portfolios. While floating-rate loans initially benefited from rising rates, the cumulative impact of higher debt service costs is now being felt by borrowers—particularly smaller, sponsor-backed companies with limited margin for error.

The recent wave of withdrawals has been concentrated in semi-liquid structures, especially BDCs and interval funds marketed to high-net-worth and retail-adjacent investors.

These vehicles typically offer quarterly or monthly redemption features—subject to gates and limits—creating the perception of liquidity in an asset class that remains fundamentally illiquid. As market volatility increased and headline risk around credit quality grew, investor behavior shifted from yield-seeking to capital-preserving.

Key drivers behind the outflows include:

- Repricing of risk: As defaults rise modestly and loan amendments increase, investors are reassessing whether spreads adequately compensate for late-cycle risk.

- Competition from public credit: Higher yields in public investment-grade and high-yield bonds have reduced private credit’s relative appeal.

- Liquidity awareness: Investors are becoming more sensitive to redemption mechanics, especially in products that promise liquidity without daily pricing transparency.

Importantly, these withdrawals are not uniform across the industry. Large institutional mandates remain largely stable. The pressure is most visible where private credit intersects with wealth distribution channels.

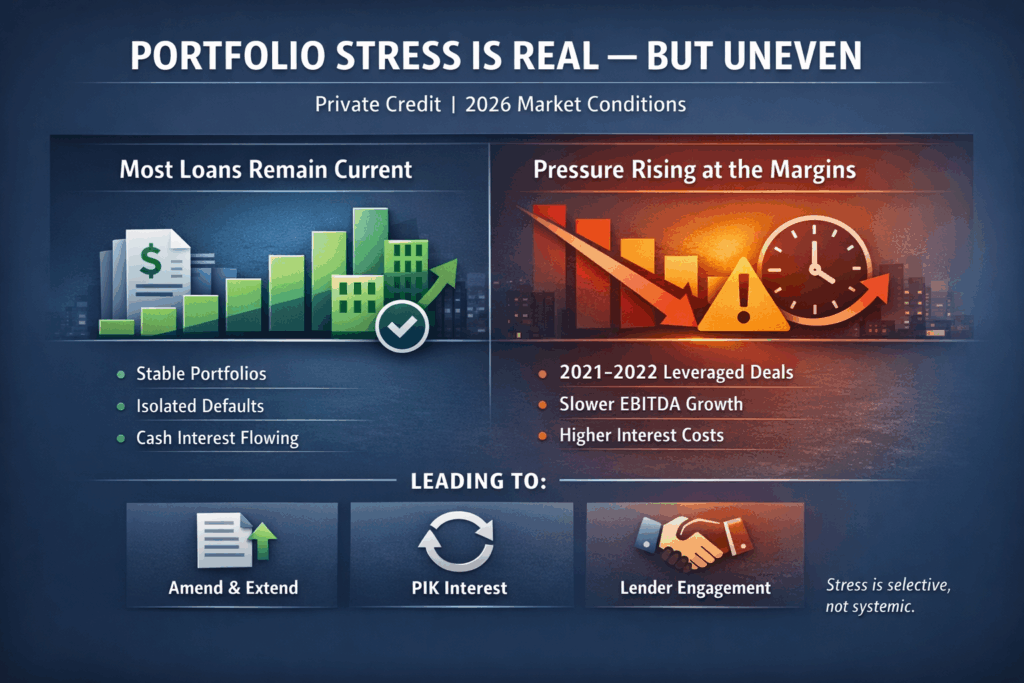

Portfolio stress is real—but uneven:

Despite the headlines, private credit portfolios are not experiencing widespread distress. Most large managers report that the majority of their loans remain current, with defaults contained to specific sectors and capital structures.

However, stress is clearly rising at the margins.

Borrowers with aggressive leverage profiles—often those financed during the peak valuation years of 2021–2022—are facing refinancing challenges. EBITDA growth has slowed, interest expense has increased, and covenant flexibility is being tested.

This has led to:

- Higher amendment and extension activity

- Increased use of payment-in-kind (PIK) interest

- More active engagement between lenders and sponsors

For experienced credit platforms, this environment is not unfamiliar. Private credit has always emphasized control rights, documentation, and sponsor relationships. The difference today is scale: with so much capital deployed, even modest stress translates into large dollar figures—and heightened investor scrutiny.

Why this moment matters for the alternative investment industry

The withdrawals mark a pivotal moment not just for private credit, but for alternative investments as a whole.

For years, the industry marketed private credit as a stable, income-oriented complement to traditional fixed income—often emphasizing low volatility and consistent returns. That narrative is now being refined.

Several structural lessons are emerging:

1. Liquidity is not a feature—it is a trade-off

Private credit delivers yield precisely because it is illiquid. When liquidity is engineered through interval funds or redemption windows, the underlying assets do not change—only the expectations do. The current episode highlights the importance of aligning liquidity terms with asset behavior.

2. Dispersion will define outcomes

As with private equity and hedge funds, performance dispersion in private credit is increasing. Scale, underwriting discipline, and workout expertise matter more than ever. The largest managers with deep restructuring capabilities are positioned to navigate stress more effectively than newer entrants.

3. Investor education is becoming critical

Wealth-channel investors entering private credit through registered products may not have lived through a full credit cycle. The industry is now focused on resetting expectations around duration, volatility, and return profiles.

How large alternative managers are responding:

Leading alternative firms are not retreating from private credit—but they are adapting.

Across earnings calls and investor updates, large managers have emphasized:

- Tighter underwriting standards for new originations

- Selective deployment focused on senior secured and asset-backed lending

- Enhanced portfolio monitoring and early intervention with borrowers

- Clearer communication around redemption mechanics and liquidity constraints

Some firms are also pivoting growth toward opportunistic and distressed credit strategies, positioning themselves to deploy capital into dislocation rather than chase late-cycle yield.

At the same time, private credit remains a core earnings engine for diversified alternative platforms. Fee-related earnings from credit strategies continue to provide stability—even as fundraising moderates.

The role of regulators and policymakers

The rise of private credit has not gone unnoticed by regulators. While the sector operates largely outside traditional banking supervision, policymakers are increasingly focused on systemic risk, leverage, and interconnectedness.

The current withdrawal episode is likely to intensify discussions around:

- Transparency in valuation practices

- Liquidity disclosures in semi-liquid funds

- Concentration risk among large non-bank lenders

While sweeping regulation remains unlikely in the near term, the direction of travel is clear: private credit is now large enough to matter at the system level, and scrutiny will rise accordingly.

What this means for investors

For institutional investors, the takeaway is nuanced. Private credit is not broken—but it is no longer a “set-and-forget” allocation. Portfolio construction, manager selection, and vintage diversification matter more than ever.

For wealth investors, the lesson is more fundamental: private credit should be treated as long-term capital, not a cash substitute. Liquidity events, when they occur, are features of the asset class—not anomalies.

Investors who understand this distinction are likely to remain committed. Those who entered the space chasing yield without fully appreciating the structure may reconsider their exposure.

A stress test, not a structural failure

Private credit’s encounter with billions in withdrawals represents its first real stress test at scale, not the end of its growth story.

The asset class still plays a vital role in corporate finance, particularly as banks remain constrained and capital markets remain episodic. Over the long term, private credit is likely to emerge more disciplined, more transparent, and more differentiated.

But the era of effortless inflows is over.

In its place comes a more mature phase—one defined by selectivity, active risk management, and a clearer understanding of what private credit truly is: illiquid capital, designed to be patient, tested in real cycles.

For the alternative investment industry, that maturation may ultimately be a sign of strength—not weakness—as private credit evolves from a high-growth product into a permanent pillar of global finance.