(HedgeCo.Net) A clear “today” trend in alternatives is the continued rise of multi-strategy / multi-manager hedge funds, powered by allocator consolidation and capacity scarcity. A Bank of America internal report cited by Reuters indicates allocators expect to direct more capital into these platforms in 2026—while holding fewer hedge fund relationships overall.

The numbers behind consolidation

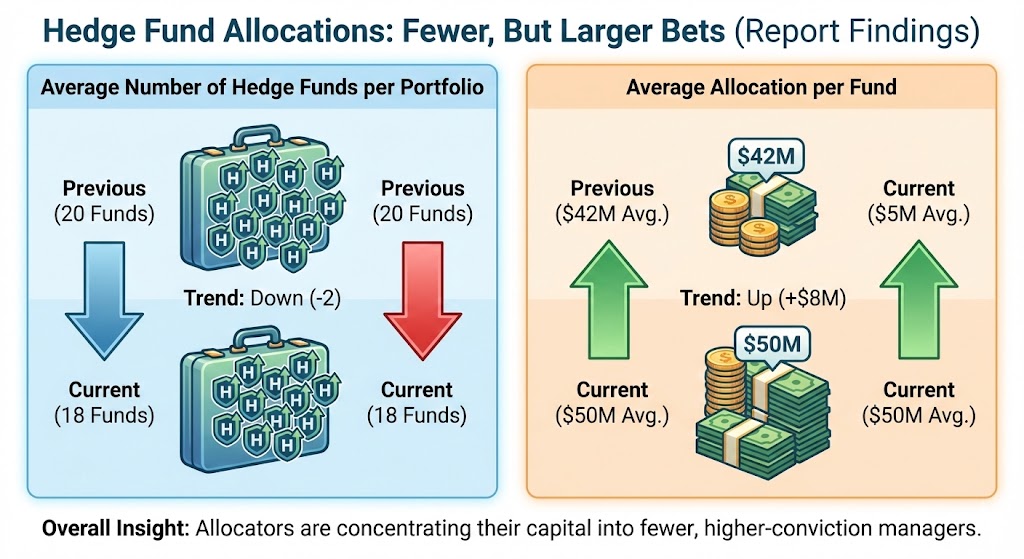

According to the report:

- the average number of hedge funds in allocator portfolios fell from 20 to 18

- average allocation per fund rose from $42M to $50M

That’s not a minor shift—it’s a structural vote for scaled platforms with institutional-grade infrastructure, risk systems, and the ability to absorb large tickets without destabilizing strategy execution.

Why multi-strats are capturing flows

1) They’re designed for today’s market regime: dispersion + volatility.

When macro cross-currents are strong and single-factor beta is less reliable, allocators pay for platforms that can dynamically allocate across pods, strategies, and geographies.

2) Capacity is becoming a strategic asset.

The report notes 62% of hedge fund investors secured increased capacity rights in 2025, up sharply from 17% in 2024—a sign that “getting in” is increasingly competitive.

3) Prime brokerage economics reinforce the flywheel.

As prime brokers earn more from financing, trading, and services tied to large multi-strats, the ecosystem strengthens—better services, better leverage terms (for the best credits), and deeper integration. Reuters has also linked strong hedge fund performance to improved prime brokerage outcomes.

What it means for hedge fund selection in 2026

Allocators are effectively saying:

“We will pay for an operating system, not just a strategy.”

That shifts diligence priorities toward:

- risk governance and drawdown controls

- pod-level talent retention and incentive design

- technology + data stack

- financing relationships and balance sheet resilience

- culture (because multi-manager blowups are often cultural failures)

The pushback: where this trend can break

- Crowding and factor convergence during stress

- Higher fixed costs that require scale to justify

- Talent churn when pods underperform

- Liquidity mismatch if portfolios lean into less-liquid instruments

Still, allocator behavior is hard to ignore: fewer relationships, bigger tickets, more capacity rights—this is how institutions behave when an asset class matures.