(HedgeCo.Net) Hedge funds are entering 2026 with a rare combination: strong recent performance in parts of the industry, rising investor demand for differentiated returns, and a growing internal debate over how to organize firms for the next decade—particularly as AI moves from “research tool” to “portfolio construction and execution engine.”

The most concrete governance headline today comes from Bridgewater Associates, which named long-time CIO Bob Prince as chair of its board after what Reuters described as a record performance year in 2025. Reuters reported that Bridgewater’s flagship Pure Alpha fund returned 34% in 2025, contributing to the firm’s most profitable year in its history. Reuters

Why it matters: Bridgewater is a bellwether for hedge fund structure

Bridgewater is often treated as an indicator for broader industry shifts—governance, research intensity, systematic macro evolution, and talent retention. Prince’s appointment, and the firm’s continuing organizational changes under CEO Nir Bar Dea, spotlight a broader 2026 question: What does the hedge fund “operating model” look like when AI changes the economics of research and the speed of decision-making? Reuters

Reuters also reported that Bridgewater has been limiting new inflows to Pure Alpha and pursuing innovation initiatives including an AI-driven fund effort referenced at roughly $5 billion in size. Reuters The message: even at the top, the industry is treating AI as a strategic priority, not a side project.

Employee ownership is back—because retention is the new alpha

Bridgewater’s planned expansion of employee ownership—over 60% of staff expected to hold equity—fits a broader hedge fund reality: the most valuable assets walk out the door every night. In a world where systematic signals commoditize, firms increasingly compete on:

- Talent density (research, engineering, execution)

- Culture that retains talent

- Platforms that let teams deploy ideas quickly and safely

- Ownership structures that reduce turnover risk

Bridgewater’s approach underscores that equity incentives are becoming a core lever again—not just for alignment, but as a defensive moat. Reuters

The other “what’s new today”: a push toward unified AI trading infrastructure

Alongside governance shifts, today’s operational trend is platform unification. Tradomatix announced the launch of a technology platform designed to connect hedge funds, quant traders, and AI trading systems in a unified environment. Finance Magnates+2Chainwire+2

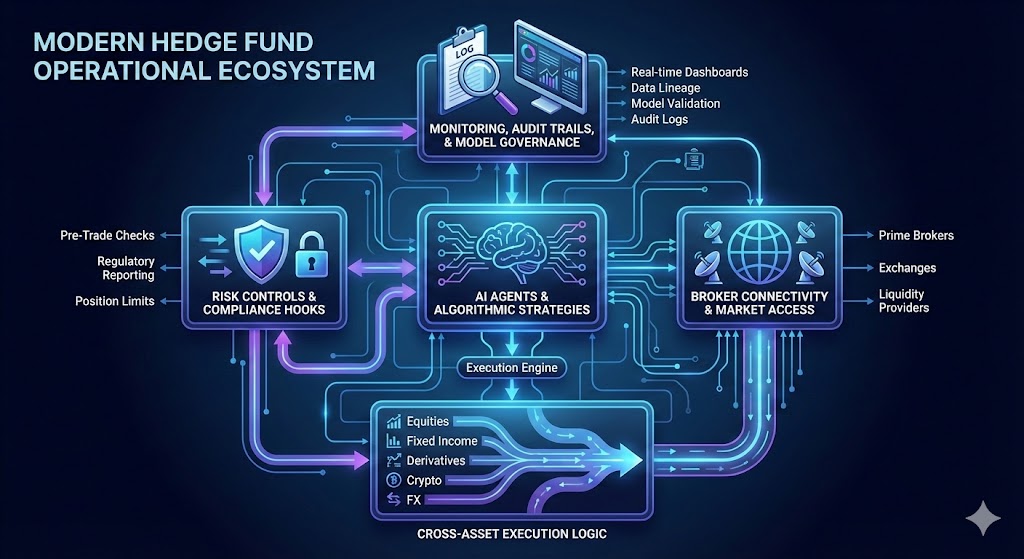

Regardless of vendor outcomes, the underlying demand is real: multi-asset funds increasingly want a single framework that can handle:

- Cross-asset execution logic

- Risk controls and compliance hooks

- Integration of AI agents or algorithmic strategies

- Broker connectivity and market access

- Monitoring, audit trails, and model governance

The industry’s center of gravity is shifting toward “AI-ready” infrastructure—because in 2026, speed and robustness are competitive advantages.

What allocators are watching now

For investors allocating to hedge funds today, the story isn’t only returns. It’s operational resilience:

- Governance clarity: leadership transitions can be disruptive—or stabilizing. Bridgewater is signaling stability and continuity through Prince’s chair role. Reuters

- AI integration: not “who uses AI,” but who uses it safely—with controls, explainability standards (where required), and disciplined deployment. Finance Magnates+1

- Talent retention systems: equity ownership, platform tooling, and culture are increasingly visible drivers of long-term performance persistence. Reuters

In short, hedge funds in 2026 are no longer just “strategies.” They are technology companies wrapped around capital—and today’s news cycle shows the leaders are structuring themselves accordingly.