By: HedgeCo Insights/Editorial Team

(HedgeCo.Com) A quiet revolution is underway in the world of finance—one that promises to fundamentally alter the trajectory of wealth creation for millions of Americans. An asset class once reserved exclusively for the ultra-wealthy, sophisticated institutions, and university endowments is now steadily making its way into the portfolios of everyday investors. With global market size now exceeding USD 20 trillion, alternative investments are no longer a niche segment relegated to the periphery of the financial system. They have become a formidable force reshaping the entire landscape of capital allocation and wealth management.(

This transformation is being driven by a powerful confluence of factors. A landmark regulatory shift in August 2025 opened the door for retirement plan participants to access alternatives through their 401(k) accounts—potentially affecting more than 90 million Americans. At the same time, market dynamics are creating a compelling case for diversification away from increasingly concentrated and expensive public equity markets.

The result may be the most profound structural change in wealth management since the advent of the modern mutual fund: the democratization of alternative investments.

This article provides a comprehensive examination of the key trends driving this transformation, the data behind the explosive growth, and the implications for investors navigating this new landscape. From the meteoric rise of private credit to the convergence of public and private markets, we explore how alternatives are becoming an essential component of a well-constructed portfolio—and what this means for the future of investing.

THE SCALE OF THE TRANSFORMATION

The growth of alternative investments over the past decade has been nothing short of extraordinary. While the headline figure of USD 20 trillion in global assets under management is impressive on its own, a deeper examination of specific sub-asset classes reveals an even more dramatic story of expansion and maturation.

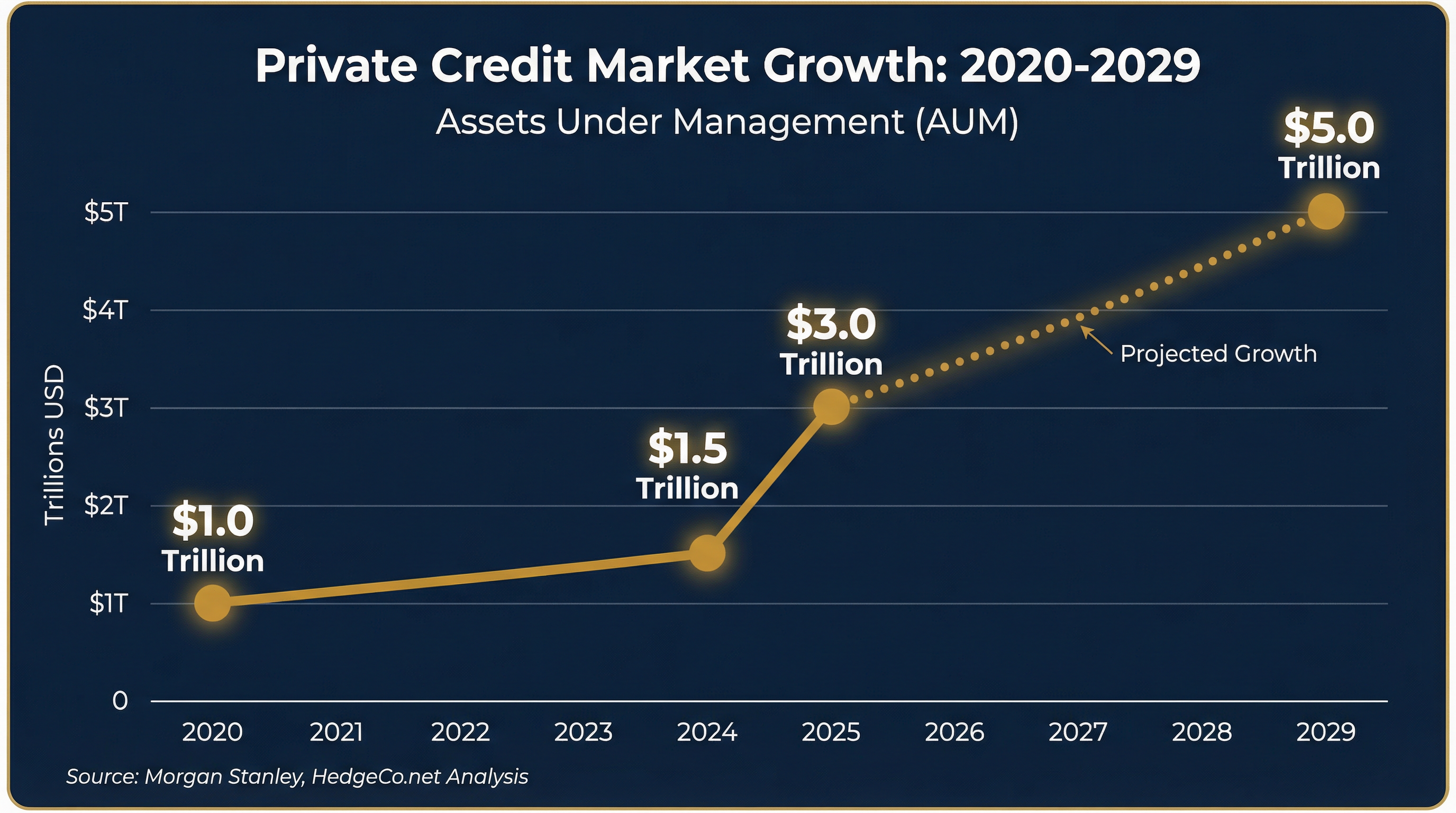

Private credit, in particular, has emerged as a powerhouse within the alternatives universe, with its market size swelling to USD 3.5 trillion as of late 2025. To appreciate the velocity of this growth, consider that just over a decade ago, in 2010, the value of private corporate loans totaled mere USD 310 billion. The market has since expanded more than tenfold.

The momentum shows no signs of abating. Private credit capital deployment surged to USD 592.8 billion in 2024, representing a remarkable 78% increase from the previous year’s deployment volumes. This acceleration is not a short-term anomaly but reflects a structural shift in how companies are choosing to finance their operations and growth. Industry projections indicate that private credit assets under management will climb to USD 4.5 trillion by 2030—effectively doubling from current levels in just five years.

This rapid expansion stands in stark contrast to the more mature and saturated traditional public markets. Public equity markets, while still massive in absolute terms, have seen growth rates moderate as the number of publicly listed companies has actually declined over the past two decades. The IPO market—once a vibrant source of new investment opportunities—has been relatively anemic in recent years.

The sheer scale of capital flowing into alternatives signifies a fundamental shift in investor sentiment and strategy, driven by a search for yield, diversification, and access to growth opportunities that are becoming increasingly scarce in the public equity and debt markets.

Diversification within alternatives is also noteworthy. While private credit has captured much of the attention, other categories such as private equity, real estate, infrastructure, and hedge funds continue to attract substantial inflows. The sector has evolved from a handful of strategies into a rich ecosystem offering exposure to corporate lending, asset-backed securities, real estate debt, infrastructure financing, and more. This diversification has made alternatives more resilient and broadened their appeal to a wider range of investors with varying risk tolerances and return objectives.

BREAKING DOWN THE BARRIERS

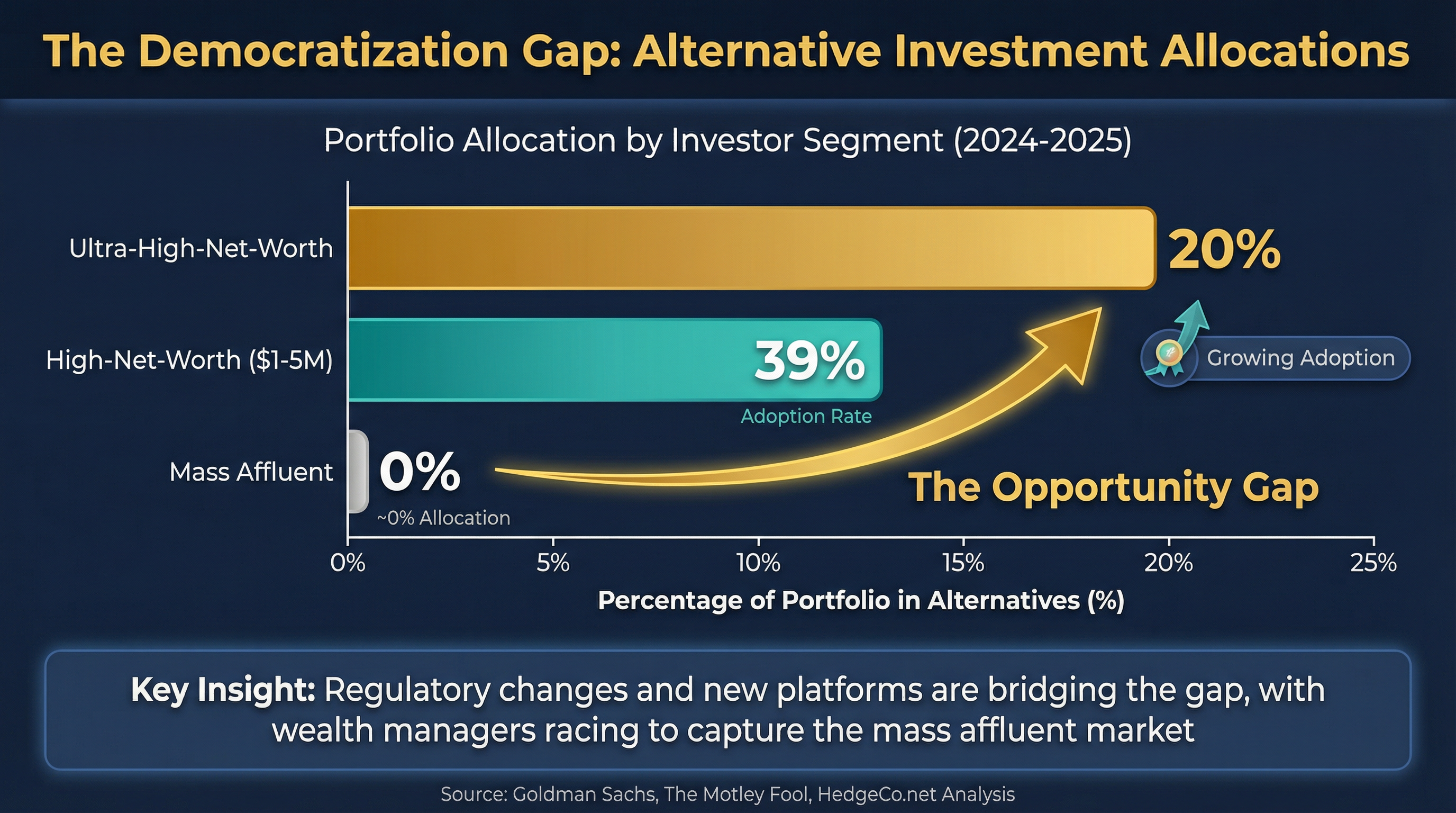

For decades, access to alternative investments was restricted by a combination of high minimum investment thresholds, complex regulatory frameworks, and distribution infrastructure that catered primarily to institutions. Regulatory definitions such as “accredited investor” and “qualified purchaser” effectively limited participation to individuals with substantial net worth or income, as well as large institutional investors like pension funds, endowments, and sovereign wealth funds.

This created a two-tiered investment landscape: the wealthiest investors had access to a broader opportunity set, while the average American was largely confined to traditional stocks and bonds.

However, the tide is turning—driven by both regulatory reform and innovation in product structures. A landmark Executive Order issued in August 2025 signaled a major policy shift at the federal level, aiming to democratize access to alternative assets for the 90+ million Americans participating in defined-contribution plans like 401(k)s. The order explicitly recognizes that wealthy Americans and government workers with access to public pension plans have long benefited from investments in alternatives, while the vast majority of private-sector workers have been denied the same opportunities.

The Executive Order directs the Department of Labor to reexamine its guidance on fiduciary duties under ERISA and clarify the circumstances under which plan fiduciaries can prudently offer asset allocation funds that include alternatives. It also calls on the SEC to consider revisions to regulations relating to accredited investor and qualified purchaser status, with the goal of expanding access for retail investors. The order prioritizes actions that would curb ERISA litigation that has constrained fiduciaries’ ability to offer innovative investment opportunities.

This move is designed to level the playing field, allowing retail investors to access the same long-term growth and diversification opportunities that have long been staples of institutional portfolios—provided appropriate safeguards and disclosures are in place.

Despite this top-down push from policymakers, adoption at the advisor level remains surprisingly low. A 2025 BlackRock analysis of nearly 2,000 advisor model portfolios found that only 18% included an allocation to alternatives. Among portfolios that do include alternatives, the average allocation is a modest 8% for moderate-risk portfolios. This gap between policy and practice highlights a significant opportunity for education and continued innovation in fund structures and distribution platforms that make alternatives easier to access and understand.

THE INVESTMENT CASE FOR ALTERNATIVES

The growing interest in alternatives is not merely a function of increased access or regulatory encouragement—it is supported by a compelling, data-driven investment case.

The year 2025 provided a real-world illustration of the potential benefits of incorporating alternatives into diversified portfolios. While traditional stock and bond markets experienced bouts of volatility amid shifting interest rate expectations and geopolitical uncertainty, many alternative strategies delivered impressive and less-correlated returns.

Gold, a classic alternative asset, had its strongest year since 1979, returning approximately 61% year-to-date as of late 2025. Liquid alternative strategies such as market-neutral equity funds also demonstrated their value. The BlackRock Global Equity Market Neutral Fund, for example, delivered returns that were roughly double those of the Bloomberg Aggregate Bond Index in 2025, extending a streak of strong performance since 2022.

A key attraction of alternatives is their historically low correlation to traditional markets, providing valuable diversification that can cushion portfolios during periods of public market stress. In a world where the traditional 60/40 portfolio has faced challenges due to rising correlations between stocks and bonds, alternatives offer a path to more meaningful diversification.

This matters even more in an environment of extreme concentration risk in public equities. The “Magnificent Seven” technology stocks—Apple, Microsoft, Alphabet, Amazon, Meta, Nvidia, and Tesla—account for roughly 35% of the S&P 500 by market capitalization. This concentration creates vulnerability for investors heavily allocated to passive index funds, where portfolio performance becomes increasingly dependent on a small group of companies.

Valuations also appear elevated by historical standards. As of late 2025, the S&P 500 was trading at a forward P/E of approximately 23x. Elevated valuations do not guarantee an imminent correction, but they can imply more modest forward returns for public equities than investors have enjoyed in recent years.

In contrast, private markets can offer attractive entry points into high-growth companies. Because private market valuations are not exposed to daily swings in public market sentiment, they can provide more stable pricing. Private companies can also focus on long-term value creation without the pressure of quarterly reporting.

Of course, alternatives are not without risk. Illiquidity is often the most significant factor, with lock-ups and limited redemption windows. Fees tend to be higher than mutual funds or ETFs, reflecting the labor-intensive nature of sourcing and managing private investments. Still, the data suggests that when properly structured and evaluated, the risk-adjusted returns of private market investments are increasingly compelling.

Importantly, key risk metrics in private credit have remained stable despite rapid growth. Non-accrual rates (loans where interest is no longer being paid) have stayed around a weighted average of 1.8%. Fund-level leverage also appears stable, with survey respondents reporting approximately USD 398 billion of borrowing—roughly 32% of net assets under management—broadly unchanged over the past decade.

THE PUBLIC-PRIVATE CONVERGENCE

A defining theme of the current environment is what J.P. Morgan Asset Management has termed a “new era of public-private convergence.” This convergence reflects several powerful trends reshaping capital markets.

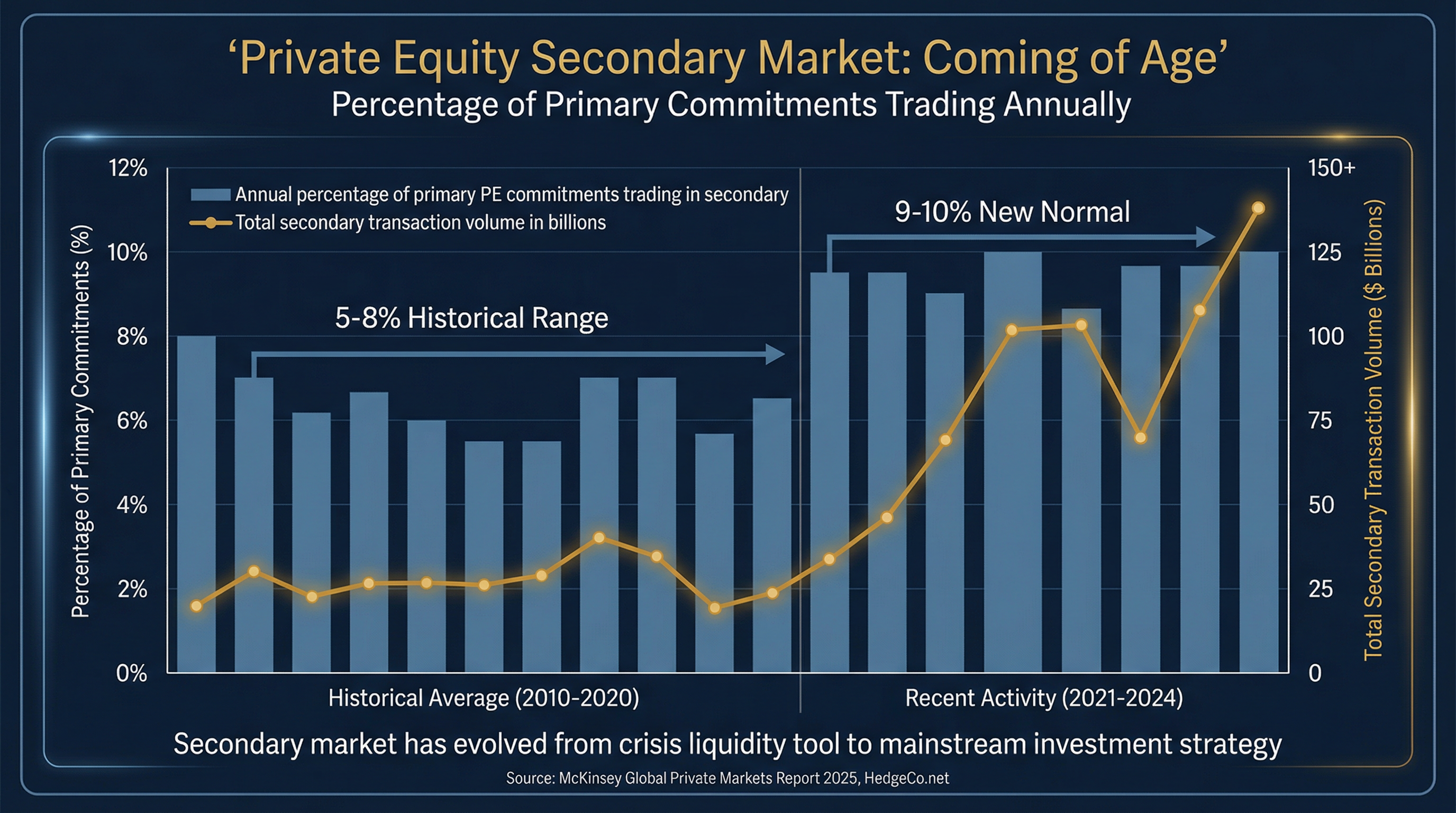

One major driver is that companies are staying private much longer than in past decades. Deep pools of private capital, combined with the burdens and short-term pressures of public markets, have reduced the urgency to pursue IPOs. In the 1990s, it was common for technology companies to go public within five to seven years of founding. Today, many remain private for a decade or more, reaching multi-billion-dollar valuations before ever listing.

This has profound implications for investors: much of a company’s growth now occurs before it reaches public markets. Investors without private equity exposure may be missing a large share of early-stage wealth creation. By the time a company goes public, a meaningful portion of the “easy money” may already have been captured by private investors.

Another driver is the massive capital investment required to build infrastructure for artificial intelligence and the broader digital economy. BlackRock Investment Institute estimates that an additional USD 5–8 trillion in AI-related capital expenditures will be needed through 2030. That includes data centers, semiconductor manufacturing, energy infrastructure, and AI applications across nearly every sector.

Much of this investment is likely to be financed via private capital—creating opportunities in private credit and private infrastructure. Public markets often struggle to finance long-duration infrastructure projects due to the pressure of quarterly results. Private capital can take a longer-term view aligned with the time horizon of these investments, creating a structural tailwind for private markets.

This trend is global. Europe now represents nearly 30% of global private credit assets under management, up materially from just a few years ago. Growth has been supported by bank retrenchment from lending following regulatory changes and a broader recognition among European investors of private credit’s role in portfolio construction.

Emerging markets are also seeing increased private investment as infrastructure needs grow, the middle class expands, and innovative companies emerge in sectors like technology, healthcare, and consumer goods. In 2025, international equities—particularly emerging markets—delivered their strongest relative returns versus the U.S. since 2006, with performance fueled by AI exposure as well as defense and financial sectors.

NAVIGATING THE NEW LANDSCAPE

The democratization of alternatives presents both major opportunity and new challenges for investors, advisors, and the wealth management industry.

As complex and often opaque instruments reach a broader retail audience, education, transparency, and due diligence become essential. Investors must understand liquidity profiles, fee structures, underlying risk factors, and how returns are generated.

Unlike publicly traded stocks and bonds with continuous pricing, many alternative investments are valued infrequently and rely on appraisals or models rather than market transactions. That can make performance harder to evaluate in real time. Fees can also be more complex—management fees, performance fees (often “2 and 20”), and other expenses that reduce net returns.

The role of financial advisors will be critical. Advisors must develop expertise in evaluating alternative managers, understanding fund structures, and conducting appropriate due diligence. This is both a challenge and an opportunity: advisors who can incorporate alternatives effectively will be better positioned to serve clients and differentiate themselves.

For investors conducting their own research, more tools are emerging. Platforms and databases now provide information on fund performance, manager track records, and strategies. HedgeCo.net, for example, offers resources to help investors understand different alternative strategies and make more informed decisions.

We are also seeing new investment vehicles designed to offer more accessible entry points for retail investors. Interval funds provide periodic redemption windows rather than daily liquidity and have become popular for private credit and other illiquid strategies. Business development companies (BDCs) provide public-market access to private-company lending. Evergreen fund structures—continuous subscriptions and redemptions within limits—are also gaining traction as a bridge between retail liquidity expectations and the illiquid nature of many alternatives.

These innovations are complemented by regulatory developments that make it easier for alternative managers to reach broader audiences. The SEC’s review of private fund marketing rules and potential expansion of the “accredited investor” definition could accelerate the trend—though investor protections and disclosure requirements must keep pace.

CONCLUSION

The democratization of alternative investments is not a cyclical trend that will fade with the next market downturn. It is a structural transformation of the investment landscape with far-reaching implications for how wealth is built and preserved in the 21st century.

Driven by regulatory tailwinds, compelling market dynamics, and innovation in fund structures and distribution, this movement is poised to reshape how a generation of Americans approaches retirement planning and long-term wealth accumulation.

The convergence of public and private markets—fueled by long-term capital needs tied to AI, the energy transition, and infrastructure development—ensures that private capital will play an increasingly vital role in the global economy. As companies stay private longer and public markets become more concentrated and potentially overvalued, the case for alternatives in a diversified portfolio becomes stronger.

For investors, the journey into alternatives should balance optimism with prudence. The potential benefits—enhanced returns, true diversification, and unique growth exposure—are compelling, but so are the complexities: illiquidity, higher fees, and manager selection risk. Success will require education, disciplined process, careful due diligence, and a long-term perspective.

In 2026, and for years beyond, unlocking the full potential of alternatives will depend on continued development of transparent, accessible, and cost-effective vehicles—supported by a regulatory framework that protects investors while fostering innovation. The revolution is here. For those prepared—armed with knowledge, guided by experienced advisors, and committed to discipline—the opportunities are immense. This is not just about access; it is about empowering a broader segment of society to participate in the wealth-creation engines long reserved for the few.