(HedgeCoB.Net) Bitcoin price dynamics, ETFs, institutional capital flows, and macro drivers In 2025, cryptocurrency markets experienced a remarkable transformation — driven by massive institutional demand, the prominence of Bitcoin/ETH exchange-traded products, and shifting macroeconomic variables. From record inflows into BTC ETFs to renewed strategic allocations by financial institutions, this year will be remembered as one of the most consequential in crypto’s evolution.

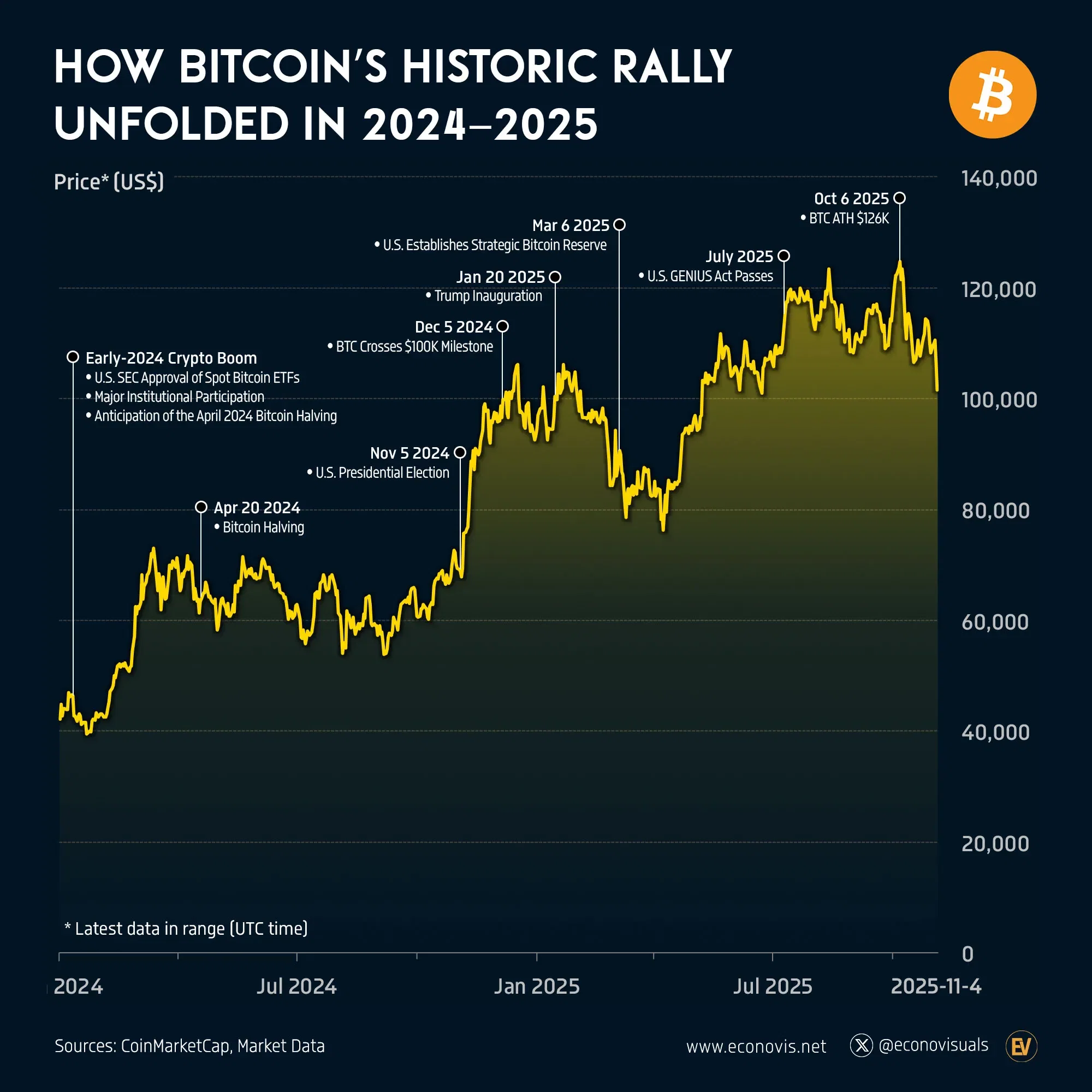

A striking milestone occurred early in 2025, when Bitcoin surpassed $100,000 — largely on the strength of U.S. spot Bitcoin ETFs, which have attracted billions in new capital and opened a broader institutional pipeline into digital assets. BlackRock’s iShares Bitcoin ETF, among others, recorded some of the largest single-day inflows ever seen for crypto products. CoinDCX

But the price narrative hasn’t been smooth: after peaking near $126,000 in October, Bitcoin retraced sharply toward the end of the year amid mixed macro signals, ETF outflows, and regulatory uncertainties — illustrating that while institutional demand remains real, markets are still sensitive to short-term capital rotations and broader economic conditions. Reuters

Institutional Adoption Accelerates

Institutional interest continues to deepen. Hedge funds, pension funds, and family offices have quietly expanded their digital asset allocations, driven by:

- A narrative shift from retail speculation to institutional diversification.

- Regulatory clarity in some jurisdictions, making crypto more palatable to risk committees.

- Better custody, compliance, and product infrastructure from major custodians and banks. EMARKETER

According to recent surveys, ultra-high-net-worth family offices increased structured crypto exposure by over 20% in 2025, reflecting a maturation of allocations beyond pure speculation into strategic positions tied to broader wealth portfolios. FNLondon

What’s Next?

As 2026 approaches, expectations hinge on further institutional normalization, potential rate cuts, and greater crypto product innovation, including staking-enabled ETFs and tokenized alternative assets — moving digital assets closer to traditional financial infrastructure.