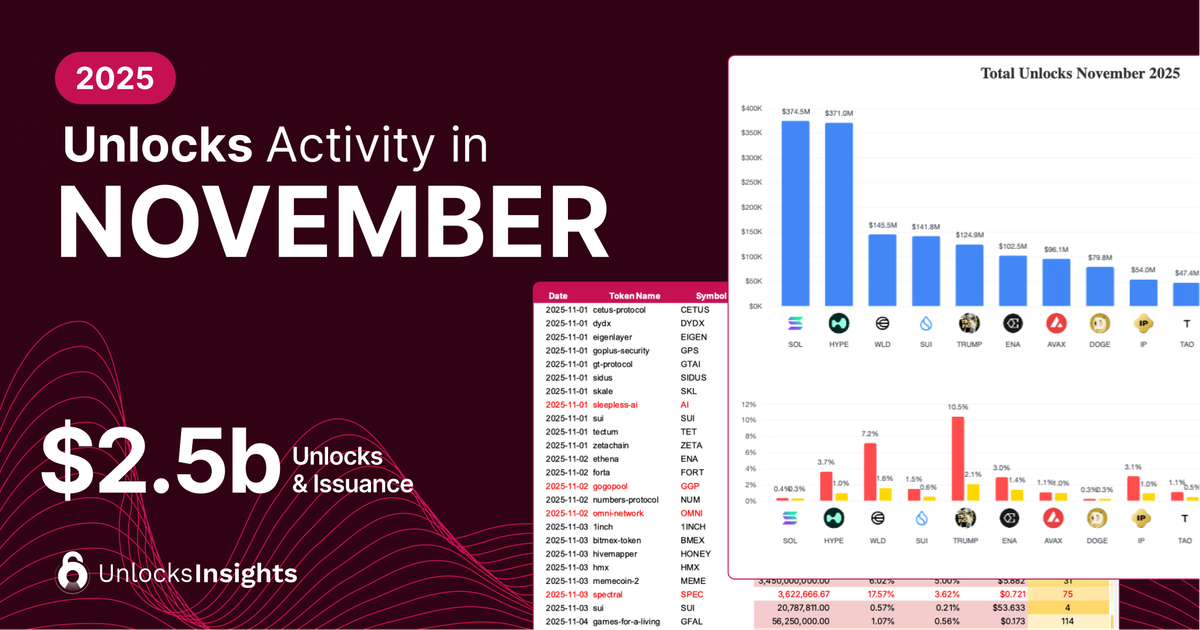

(HedgeCo.Net) Market participants are keeping a close eye on large-scale token unlocks set for November 2025—events that can influence short-term volatility and supply/demand dynamics. BeInCrypto

Key stats:

- Over US $476 million worth of tokens are scheduled to unlock across multiple networks this week. BeInCrypto

- Example: Linea (LINEA) will release ~2.88 billion tokens (?4 % of total supply) on 10 November—valued around US $37.9 million. BeInCrypto

- Other projects include L1s and L2s such as Aptos (APT) and Avalanche (AVAX), whose unlocks may add supply pressure. BeInCrypto

Why it matters: Token unlock events release supply that was previously locked or vested. If demand doesn’t scale accordingly, prices may face downward pressure. Conversely, if the market absorbs the new supply with positive sentiment, the unlocks can pass with limited damage.

What to watch:

- Price action of projects immediately post-unlock: how resilient they are.

- Whether teams or insiders dump unlocked tokens or hold them for longer term.

- Overall market sentiment: in a bullish environment, unlocks may be absorbed; in a weak environment, they may trigger spill-over risk.