(HedgeCo.Net) Liquid alternatives are no longer simply seen as an overweight “add-on” to portfolios; in 2025 many institutional investors and asset managers are integrating them as a core building block. A recent report from BlackRock noted that clients are increasingly using hedge-fund-style and liquid?alts exposure both as a diversifier and as partial replacement for traditional equity or fixed-income allocations. BlackRock

Examples from the BlackRock note:

- In Australia, BlackRock’s “Global Liquid Alternatives Fund” saw AU$125 million net inflows this year, boosting AUM by over 160 %. BlackRock

- Clients are demanding multi-strategy, systematic and global-macro hedge-fund style allocations in liquid form, rather than simple long-only exposures.

- The competitive edge: as equity/bond correlations rise and diversification benefits erode, liquid alts may offer both risk mitigation and active return potential.

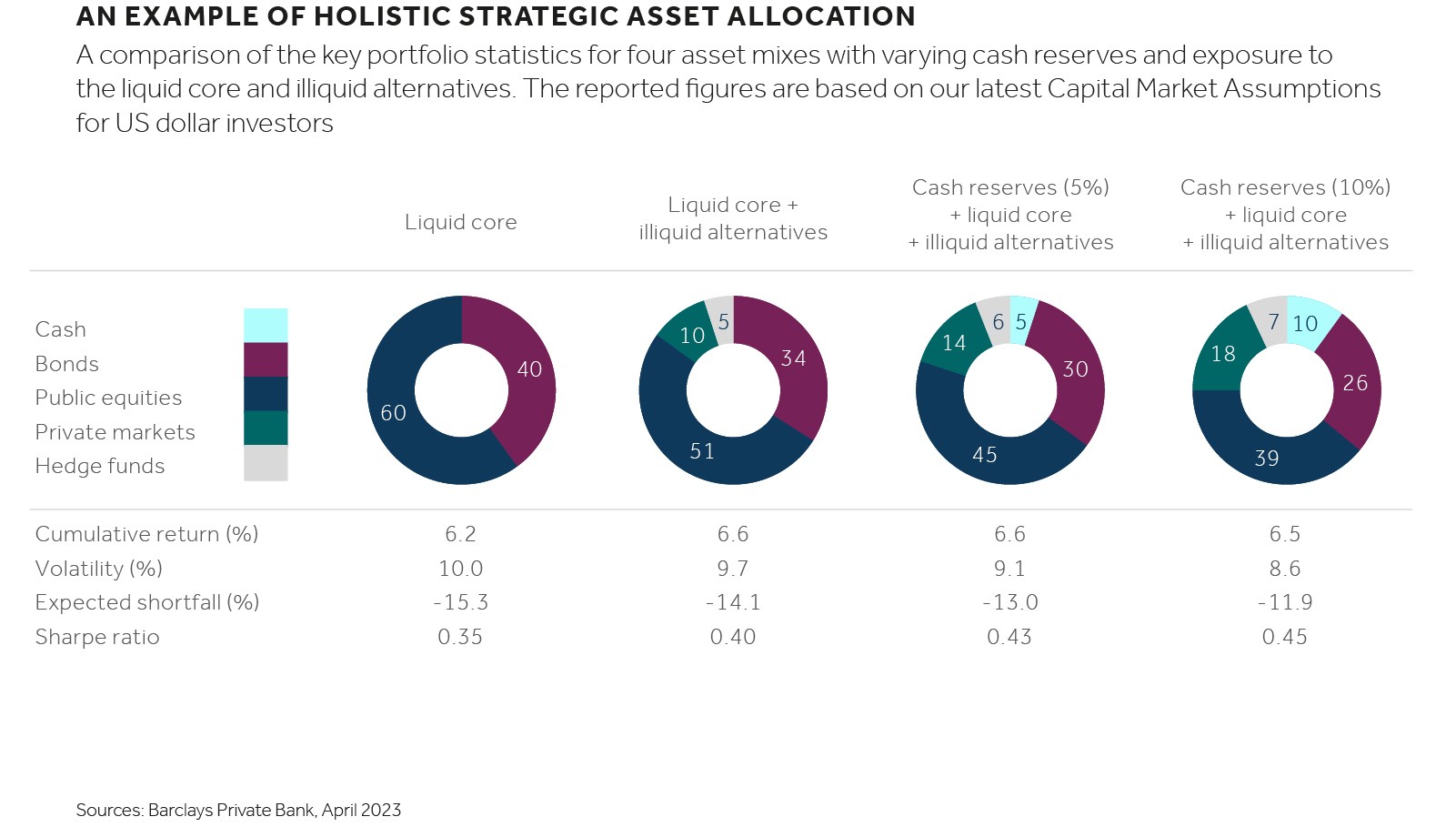

From the investor side, this shift means that liquid alts are going from the “nice to have” to the “must have” category. Many asset allocators are asking: how much liquid alts exposure do we need to make our portfolio more robust against regime change? On the manager side, it means an increasing focus on operational transparency, fee compression and liquidity terms.

Key risk: As liquid alts scale up and become more mainstream, there’s a risk of crowded trades, fee compression and performance convergence. Simply adding liquid alts without differentiation may not yield outsized diversification benefit.

Bottom line: For portfolio architects, 2025 may be the year to seriously revisit allocation architecture and consider how liquid alts fit in as a core element — not just an exotic side-bet.