While researching in nuclear power, we uncovered an attractive opportunity to invest in physical uranium for power plants. We found that the prices of the uranium metal were less volatile and more consistent than the related equities.

The following chart clearly illustrates the challenges facing the uranium mining industry. There is a substantial imbalance between the demand and supply for physical uranium for nuclear power plants. This imbalance has persisted for nearly 20 years, and the gap has been supplied by sales of excess uranium from military programs of Russia and the US. However, these stockpiles are largely depleted.

How will the demand be met in the future? For 20 years prior to 2003, the uranium mining industry was under-invested. It takes 10 years to bring a new mine into production because of lengthy environmental permitting and technology issues associated with lower grade and more complex ore bodies.

The following chart shows the monthly price history of U3O8 since 1970. Uranium prices have increased from $ 10 per lb as late as 2003 to nearly $ 50 per lb today. We believe that uranium prices will continue to increase because it is believed that supply will not meet demand until 2013. In real terms, the current price is still only about 42% of the price reached during the 1970s peak.

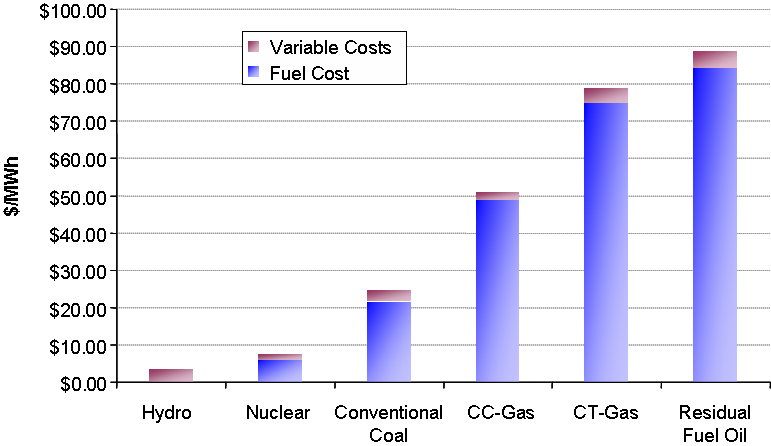

Demand for uranium is strong. As the following chart shows, nuclear power plants can continue to compete with fossil fuel-fired units, even supposing a several-fold increase in the price of nuclear fuel. Existing plants are being pushed to their limits: 92% operating factors last year, compared to 75% 10 years ago. Nuclear power does not contribute to global warming and environmentalists are now big supporters. There are over 25 new nuclear plants under construction and more than another 150 in the planning stages.

The strategy of the Solios Uranium Fund is to buy and hold physical uranium for long term gain. The Fund will consist of 75% physical uranium and 25% uranium equities. The equities will be used to hedge or enhance returns.

The Solios Uranium Fund launched on Sept 1 with seed money from the Solios Offshore Fund. Response has been very favorable as it is the only hedge fund which is a pure play on uranium. As indication of market interest, there is a closed end fund which holds physical uranium and trades at a 30% premium to its NAV.

The exit strategy of the Fund is to liquidate the physical uranium opportunistically, and return money to investors. Solios is also researching other specialized commodity plays.